Medicare Part D

Medicare Part D helps pay for prescription drugs. It’s offered by private insurance companies approved by Medicare. You can get Part D as a separate plan or as part of a Medicare Advantage (Part C) plan.

Why You Need Medicare Part D?

Medicare has four parts: A, B, C, and D. Original Medicare (Parts A and B) covers hospital and medical care but not most prescription drugs.

● Medicare Advantage (Part C): Some plans include drug coverage (MAPD). If yours does, you don’t need Part D.

● Part D: Covers prescription drugs from your pharmacy. You need it if your Medicare plan doesn’t include drug coverage unless you have VA or TRICARE benefits.

Even if you don’t take medications now, enrolling in Part D when first eligible helps you avoid late penalties. If you miss the deadline, you’ll have to wait until the next Annual Election Period (AEP) for coverage.

Medicare Part D Penalty Made Simple

If you don’t sign up for a Part D plan when first eligible and go 63 days or more without drug coverage, you’ll have to pay a monthly penalty for life when you do enroll. The longer you wait, the more you’ll pay.

The penalty is 1% of the national base premium ($32.74 in 2023) for each month without coverage.

For example, if Jim waited 36 months, his penalty would be:

36 x 1% x $32.74 = $11.80

This is on top of his plan’s monthly premium, deductibles, and copays. Since the base premium increases each year, his penalty will also go up over time. To avoid this, enroll in Part D even if you don’t take medications now.

What Drugs Are Covered Under Medicare Part D?

Medicare Part D plans must cover all vaccines needed to prevent illness. Each plan has its own list of covered drugs (formulary), so some may cover your medication while others may not.

All Part D plans must cover at least two drugs per condition and must include:

● Antidepressants

● Anticonvulsive

● Antipsychotics

● Cancer drugs

●HIV/AIDS treatments

●Immunosuppressants

Drugs are placed in tiers—lower-tier drugs cost less than higher-tier ones.

Before choosing a plan, make a list of your medications and compare it to available plans to ensure coverage.

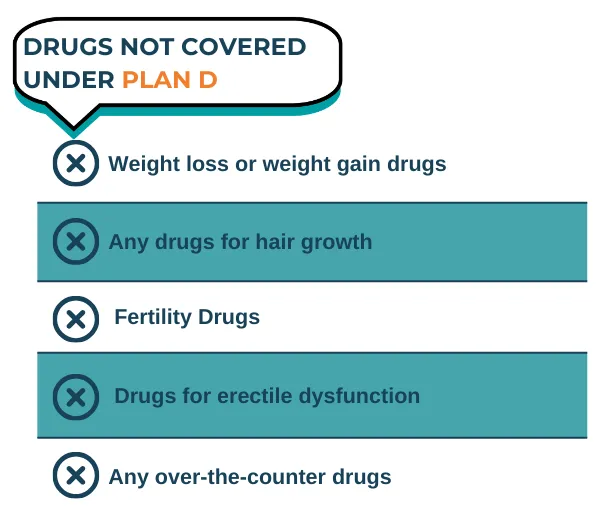

What Drugs Are Not Covered Under Medicare Part D?

While each Part D plan covers different medications, some are almost never covered, including drugs for:

● Weight loss or weight gain

● Hair growth

● Fertility

● Erectile dysfunction

Part D also does not cover over-the-counter medications like pain relievers (acetaminophen, ibuprofen) or cough syrup.

How to Choose a Medicare Part D Plan

Picking a Part D plan may seem simple, but plans can be complex. You can use Medicare’s Plan Finder Tool or get help from an independent insurance agent to avoid mistakes and get support if issues arise.

Here’s how we help you choose the right plan:

1. Compare Your Medications – We check which plans cover your prescriptions.

2. Include Your Preferred Pharmacy – Not all plans work with every pharmacy.

3. Find the Best Coverage – We look for plans that cover most or all of your medications.

4. Lower Your Costs – We compare total yearly costs, including premiums and prescription prices.

The best plan is the one that covers your medications at the lowest total cost for the year.

Changing Your Part D Plan

Once you enroll in a Part D plan, you must keep it for the year unless you qualify for a Special Enrollment Period due to a major life event. If your prescription changes, your plan may still cover it, but if not, ask your doctor about alternatives.

You can switch plans during Medicare’s Annual Election Period (AEP), from October 15 to December 7, with changes taking effect on January 1.

Why Review Your Plan Every Year?

● Plans change yearly, so even if you're happy with your current plan, review it during AEP.

● In September, your plan will send an Annual Notice of Change (ANOC) with updates.

● Other plans may offer better benefits or lower costs, so it’s worth comparing.

Plan Changes & Notifications

● Plans must notify you of drug removals, price changes, or tier adjustments.

● Between AEP and 60 days after coverage starts, drug lists and prices cannot change, except for safety reasons or manufacturer discontinuation.

● Any updates must include drug names, reasons for changes, alternative options, and exception processes.

Your Rights to a Prescription Drug Plan

Once you enroll in a Part D plan, you have the right to:

● Get a written explanation of your benefits.

● Request an exception if your needed medication isn’t covered.

● Ask for an exception to waive certain rules.

● Request lower copayments for expensive drugs if cheaper alternatives don’t work for you.

Medicare Part D

Enrolling in

MEDICARE MEDICARE PART D

There’s a lot to think about when selecting a Part D plan, especially with so many options available. It can feel overwhelming, but you don’t have to go through it alone! Our agents will compare plans from multiple carriers to help you find the right fit. Best of all, our services are completely free.

Once you’ve chosen a plan, enrolling is easy. We’ll handle the paperwork, help you set up your premium payments, and submit the application for you.

Our support doesn’t stop there. We’ll always be available to answer your questions and assist with any future changes.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.