Medicare Enrollment Periods

Understanding Medicare enrollment periods is crucial for securing the health coverage you need while avoiding penalties or gaps in coverage. Below is an overview of the key Medicare enrollment periods and what you should know about each.

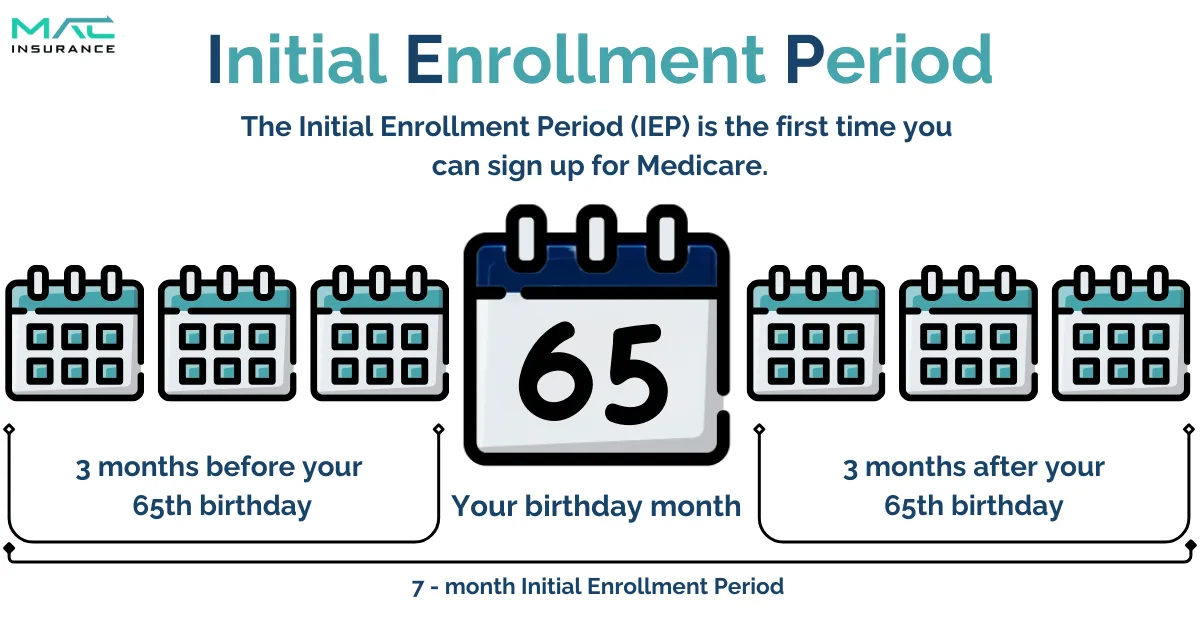

Initial Enrollment Period (IEP)

Your Initial Enrollment Period (IEP) is tied to your 65th birthday month and lasts seven months. It begins three months before your birthday month, includes your birthday month, and ends three months after.

For example, if your birthday is July 2, your IEP runs from April 1 through October 31. Enrolling before your birthday month allows coverage to begin as early as the first day of your birthday month, meaning your Medicare would start on July 1 in this case.

Exception for Birthdays on the First of the Month:

If your birthday falls on the first day of the month, your IEP starts one month earlier. For instance, if your birthday is July 1, your IEP begins on March 1, and coverage takes effect on June 1.

During your IEP, it’s important to enroll in Medicare Parts A and B, as well as any additional coverage you may need, such as a Medicare Supplement plan, a Medicare Advantage plan, or Medicare Part D.

Planning Ahead is Key:

Failing to enroll during your IEP can result in a gap in coverage and late enrollment penalties unless you have other creditable coverage.

Creditable Coverage:

Employer-sponsored group health plans with at least 20 employees typically qualify as creditable coverage, allowing you to delay Medicare enrollment without penalties. However, confirm with your HR department or advisor before making this decision to ensure compliance and avoid unexpected penalties.

General Enrollment Period (GEP)

When It Occurs:

The General Enrollment Period takes place annually from January 1 to March 31.

What You Can Do:

If you missed your Initial Enrollment Period, this is your opportunity to enroll in Medicare Part A and/or Part B. Coverage will start on July 1 of the same year.

Penalties:

If you delay enrolling when first eligible and don’t qualify for a Special Enrollment Period, you may be subject to late enrollment penalties.

Medigap Open Enrollment Period

What Is Medigap?

Medigap, also known as Medicare Supplement Insurance, is designed to enhance your coverage under Original Medicare. While it’s not mandatory, many individuals opt for either a Medigap plan or a Medicare Advantage plan to fill coverage gaps.

Enrollment Period:

The Medigap Open Enrollment Period begins when your Medicare Part B becomes effective and lasts for six months. This is a one-time window to enroll without needing to pass medical underwriting.

Key Consideration:

If you miss this enrollment period, obtaining a Medigap plan later typically requires passing medical underwriting, unless you qualify for specific exceptions.

Need Assistance?

If you’re outside the enrollment period but still interested in Medigap, reach out to an advisor at MAC Insurance for guidance on your options.

Special Enrollment Periods (SEP)

When They Occur:

Special Enrollment Periods happen outside the standard enrollment windows and are triggered by specific life events, including:

Loss of Other Coverage: If you lose creditable health coverage, such as employer-sponsored insurance, you may qualify for an SEP to enroll in Medicare without penalty.

Relocation: Moving to a new area that impacts your current plan’s network or coverage may make you eligible for an SEP.

Other Life Changes: Situations like qualifying for Extra Help with prescription drug costs can also activate an SEP.

What You Can Do:

SEPs provide an opportunity to enroll in or modify your Medicare coverage, including Parts A, B, C, or D, depending on your individual circumstances.

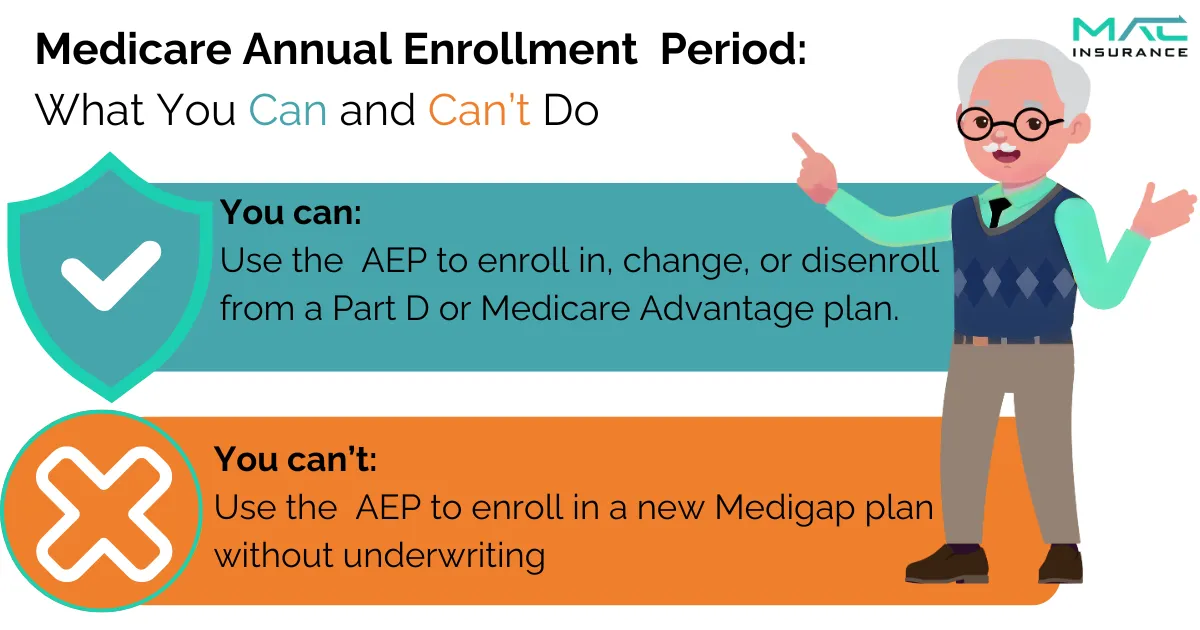

Medicare Annual Enrollment Period (AEP)

The Annual Election Period (AEP) is a key Medicare enrollment window that every beneficiary should keep in mind, regardless of their current Medicare plan.

When It Happens:

AEP occurs every year from October 15 to December 7.

What You Can Do During AEP:

This period allows you to make important changes to your Medicare coverage, including:

● Updating or switching your Medicare plans.

● Reviewing your current coverage to ensure it still meets your needs.

● Exploring new plan options for the upcoming year.

Switch from one Medicare Advantage plan to another

Switch from one Part D plan to another

Change from Medicare Advantage to Original Medicare

Change from Original Medicare to Medicare Advantage

Any changes you make go into effect on January 1 of the upcoming year.

Why AEP Matters:

Medicare Advantage and Part D plans operate on annual contracts, meaning plans often change from year to year. While your current plan will renew automatically if you take no action, key details like premiums, deductibles, cost-sharing, and benefits may shift.

For instance, a medication you’ve been taking for years might no longer be covered, or another plan could offer lower copays or better benefits than your current one.

Review Your Plans:

Even if you don’t plan to make changes, it’s essential to review your coverage during AEP to ensure it still meets your needs. Let MAC Insurance help you stay informed and make the best decisions for your Medicare coverage.

Ready to compare Medicare Options?

Call us today!

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is a yearly opportunity that runs from January 1 to March 31.

Who Can Use It:

This period is exclusively for beneficiaries already enrolled in a Medicare Advantage plan.

What You Can Do:

● Make a one-time change to your current Medicare Advantage plan.

● Switch back to Original Medicare. If you choose to return to Original Medicare, you can also select a Part D prescription drug plan during this time.

When Changes Take Effect:

Any changes made during this period will take effect on the first day of the following month.

Late Enrollment Penalties

We mentioned some late enrollment penalties earlier. It’s time to talk about what those are so you can see the benefit of not delaying your Medicare enrollment.

Part B Late Enrollment Penalties

For each 12-month period you delay enrolling in Part B, you’ll face a 10% penalty. This means an additional 10% of the standard monthly premium will be added to your Part B premium. For example, if you wait two years to enroll, you’ll pay an extra 20% per month. This penalty will continue for as long as you have Part B coverage.

Part D Late Enrollment Penalties

The Part D penalty is determined by the number of full months you went without prescription drug coverage. Even if you're not currently taking medications, you can still face this penalty. Many people mistakenly believe that if they aren’t using prescription drugs, they don’t need drug coverage, which is why the Part D penalty is so common. However, there are low-cost Part D plans available that can help you avoid this penalty if you don’t require extensive drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying it by the number of months you lacked coverage. Since the base premium changes each year, your penalty will also vary. Like the Part B penalty, the Part D penalty remains in effect for as long as you're enrolled in a Part D plan.

Don’t wait until the last minute to enroll in Medicare. If you’re approaching your 65th birthday, now is the perfect time to start planning. Reach out to an expert at MAC Insurance to learn more about Medicare enrollment and your plan options.

Medicare Explained

More Information on Understanding

ENROLLMENT PERIODS

Understanding the differences between enrollment periods can be challenging. However, keeping track of them is essential to avoid missing cost-saving opportunities. Our agents are here to guide you through the process and keep you informed about upcoming enrollment periods.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

What does IEP mean?

IEP stands for Initial Enrollment Period, the time when you first become eligible for Medicare, starting three months before your 65th birthday and ending three months after.

What does GEP mean?

GEP stands for General Enrollment Period, which runs from January 1 to March 31 each year for those who missed their Initial Enrollment Period.

What does SEP mean?

SEP stands for Special Enrollment Period, which allows you to enroll in Medicare outside of the usual enrollment periods if you meet certain qualifying circumstances, such as losing employer coverage.

What does AEP mean?

AEP stands for Annual Enrollment Period, which runs from October 15 to December 7 each year. During this time, Medicare beneficiaries can make changes to their Medicare Advantage and Part D prescription drug plans.

What is the difference between the IEP and the GEP?

The Initial Enrollment Period (IEP) is when you first become eligible for Medicare, typically around your 65th birthday. The General Enrollment Period (GEP) is for those who missed their IEP, allowing them to enroll from January 1 to March 31 each year.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.