Medicare Supplement Plan Comparison

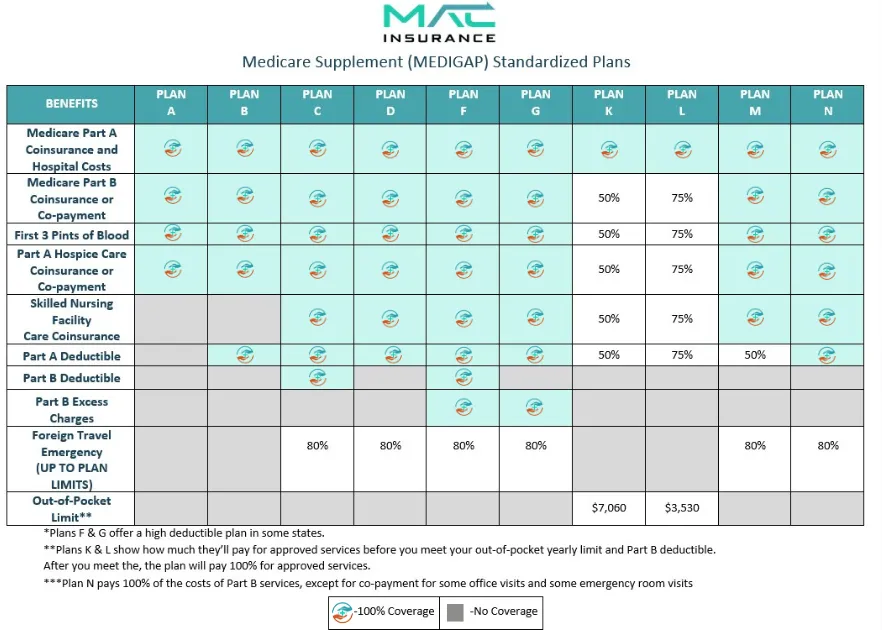

Medicare Supplement Plan Comparison – There are 10 Medicare Supplement Insurance plans, labeled A through N. Each plan offers different levels of coverage to fill the “gaps” left by Original Medicare.

Also known as Medigap plans, Medicare Supplement plans are provided by private insurance companies that are licensed by Medicare. All plans must offer standardized coverage and use the same letter labels, regardless of the insurance company. The primary difference between plans is the premium cost.

Below, we’ve outlined the coverage provided by each Medigap plan to help you make an informed decision about your healthcare coverage.

Which Medicare Supplement Plan is the best?

As shown in the chart below, Medicare Supplement Plan F offers the most comprehensive coverage.

Plan F covers:

● The deductible for Original Medicare Part A

● The deductible for Part B, along with Part B excess charges

● Part A coinsurance and hospital costs for up to an additional 365 days after Medicare benefits are exhausted

● Part B coinsurance or copayments

● The first three pints of blood used in an approved medical procedure

● Skilled nursing facility coinsurance

● 80% of foreign travel emergency expenses (up to plan limits)

Thanks to the extensive coverage it provides, Plan F is one of the most popular Medigap plans.

Plan G is another widely chosen option as it offers nearly the same coverage as Plan F. The key difference is that Plan G does not cover the Medicare Part B deductible, which was $185 in 2019. If you can find Plan G at a significantly lower premium than Plan F, it might make sense to pay the one-time Part B deductible and save on the monthly premium for your supplemental plan.

What do Medicare Supplement Plans cover?

If you prefer a quick summary instead of the chart above, here’s a concise overview of what each Medigap plan covers:

Medigap Plan A is the most basic option, providing coverage for the 20% that Original Medicare doesn’t cover. It includes Part A coinsurance and hospital costs, Part B coinsurance or copayments, the first three pints of blood used in a medical procedure, and Part A hospice care coinsurance or copayments. Despite being the most basic plan, it remains an effective way to save on healthcare costs.

Medigap Plan B provides all the coverage offered by Plan A—such as Part A coinsurance and hospital costs, Part B coinsurance or copayments, the first three pints of blood used in a medical procedure, and Part A hospice care coinsurance or copayment—and also covers the deductible for Medicare Part A.

Medigap Plan C covers all out-of-pocket costs associated with Original Medicare, except for Part B excess charges. It also covers 80% of foreign travel emergency expenses (up to the plan's limits). Plan C is one of the most comprehensive Medicare Supplement plans available.

Medigap Plan D covers all out-of-pocket costs associated with Original Medicare, except for the Part B deductible and excess charges. It also provides coverage for 80% of foreign travel emergency expenses (up to the plan’s limits).

Plan F offers the most comprehensive coverage by filling all the gaps, including the Medicare Part B deductible. However, it is no longer available to new Medicare beneficiaries as of January 1, 2020. Existing beneficiaries can retain it, but new enrollees will need to consider alternative plans, such as Plan G.

Plan G is widely regarded as one of the most popular and comprehensive Medigap plans. It covers most of the gaps left by Original Medicare, including Part A coinsurance, Part B coinsurance, and foreign travel emergency care. While it does not cover the Medicare Part B deductible, it provides extensive coverage at generally lower premiums compared to Plan F.

Plan K covers 50% of your Medicare Part B coinsurance or copayments, the first three pints of blood used in a medical procedure, Part A hospice care coinsurance or copayments, skilled nursing facility coinsurance, and the Medicare Part A deductible.

Plan L covers 75% of your Medicare Part B coinsurance or copayments, the first three pints of blood used in a medical procedure, Part A hospice care coinsurance or copayments, skilled nursing facility coinsurance, and the Medicare Part A deductible.

Plan M covers all of your Medicare Part B coinsurance or copayments, the first three pints of blood used in a medical procedure, Part A hospice care coinsurance or copayments, skilled nursing facility coinsurance, and the Medicare Part A deductible. It also covers 50% of the Part A deductible and 80% of foreign travel emergency expenses.

Medigap Plan N covers all out-of-pocket costs associated with Original Medicare, except for the Part B deductible and excess charges. It also covers 80% of foreign travel emergency expenses (up to plan limits). Plan N is considered one of the most comprehensive supplement plans.

Plan N provides solid coverage at lower premiums compared to Plan G and Plan F. It covers Part A coinsurance, Part B coinsurance, and foreign travel emergency care but requires some cost-sharing for doctor visits and emergency room visits.

Get Medicare Help from an Expert

If you find a plan above that seems like a good fit or if you need assistance in making your decision, reach out to one of our licensed Medicare agents. We're here to help you find a plan that suits your budget and healthcare needs!

Contact us today to schedule a free consultation and learn how we can guide you through your Medicare options with confidence.

Medicare Supplements

Comparing

MEDICARE SUPPLEMENT PLANS

Medicare Supplement plans, or Medigap, help cover out-of-pocket expenses such as copayments, coinsurance, and deductibles that Original Medicare (Parts A & B) doesn’t cover. These plans are provided by private insurers and are standardized in most states.

For guidance on your Medicare eligibility, reach out to an expert today!

ADDITIONAL QUESTIONS TO BE ADVISED ON:

What is Medicare Supplement Insurance (Medigap)?

Medigap insurance, also called Medicare supplement or gap insurance, helps cover costs that Original Medicare doesn’t pay for.

When is the enrollment period for a Medicare supplement plan?

Once you’re enrolled in Medicare Parts A and B, you can sign up for a Medigap plan. You have a 6-month enrollment period starting from your Part B effective date, during which you have guaranteed issue rights. This ensures you can enroll in any plan without being denied due to health conditions. After this period, you may need to go through medical underwriting for approval.

How do Medigap plans work?

Medigap plans act as secondary insurance to Original Medicare, covering some or all out-of-pocket costs left by Medicare Parts A and B, depending on the plan selected.

Are there any free Medicare supplement plans?

All Medicare supplement plans require a monthly premium, unlike some Medicare Advantage plans that may have $0 premium options. However, Medicare Advantage plans have certain limitations and do not provide the same level of comprehensive coverage as Medigap plans.

Can I have both a Medicare supplement and a Medicare Advantage plan or two Medicare supplement plans?

No, you can have either a Medicare supplement plan or a Medicare Advantage plan, but not both.

Will my doctor accept my Medicare supplement plan?

If a provider accepts Medicare, they will also accept your Medicare supplement plan.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.