What is Medicare?

Medicare is a federal health insurance program for people 65 and older. It also helps some younger people with disabilities or certain health conditions. Medicare has different parts, and each one covers specific types of care. Knowing how Medicare works can help you pick the plan that’s right for you.

How Does Medicare Work?

Medicare eligibility generally starts at age 65, but younger individuals with disabilities or certain health conditions may also qualify. Enrollment starts three months before you turn 65 and continues for seven months—three months before, the month of, and three months after your 65th birthday. If you’re under 65 and qualify due to a disability, you’ll be automatically enrolled after receiving Social Security Disability Insurance (SSDI) benefits for 24 months.

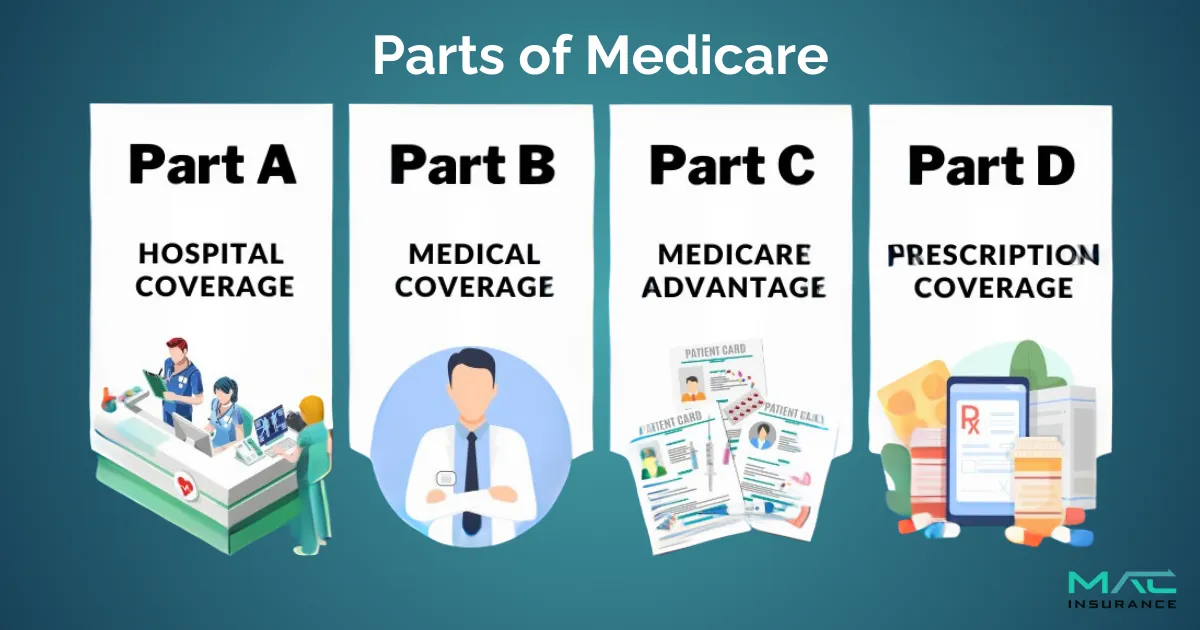

Medicare is divided into different parts to cover various healthcare needs:

Original Medicare (Parts A & B): This is the traditional Medicare program run by the federal government.

● Part A covers inpatient hospital care, skilled nursing facilities, hospice care, and some home healthcare.

● Part B covers outpatient care, doctor visits, preventive services, and medical supplies.

Medicare Advantage (Part C): These are private plans approved by Medicare. They include all the benefits of Original Medicare (Parts A & B) and often provide extra coverage like vision, dental, and prescription drugs.

Medicare Prescription Drug Plans (Part D): These private plans help cover the cost of prescription medications.

When signing up for Medicare, you can choose between Original Medicare or a Medicare Advantage plan. Each option differs in cost, coverage, and provider networks, so it’s important to consider your healthcare needs, budget, and personal preferences.

Original Medicare

Part A (Hospital Insurance):

Part A helps pay for inpatient care in hospitals, skilled nursing facilities, hospice care, and some home healthcare services. Most people don’t have to pay a monthly premium for Part A if they or their spouse worked and paid Medicare taxes for at least 10 years. However, you may still have deductibles and coinsurance costs for the services you use.

Part B (Medical Insurance):

Part B covers outpatient services, including doctor visits, preventive care (such as flu shots and screenings), and necessary medical services like lab tests, x-rays, and durable medical equipment. Part B typically requires a monthly premium, which depends on your income. It also has an annual deductible, and for most services, you’ll pay 20% of the Medicare-approved amount.

With Original Medicare, you can see any doctor or specialist who accepts Medicare, without needing a referral. However, it doesn't cover all healthcare costs, such as most prescription drugs, routine vision or dental care, hearing aids, or long-term care. To cover these additional services, many people choose to buy supplemental coverage (Medigap) or enroll in a Medicare Advantage plan.

Medicare Explained

Want more help understanding

MEDICARE?

We’re here to help you better understand your Medicare benefits, including Medicare supplements, Medicare Advantage plans, and prescription drug coverage. Learning about these options can help you lower your out-of-pocket healthcare costs that Medicare doesn’t cover.

To make things easier, we’ve put together a comprehensive library of resources for you to explore. When you’re ready, give us a call, and one of our licensed agents will discuss your specific needs, compare available plans in your area, and guide you toward the best choice.

If you decide to enroll through us, our support doesn’t stop there. We’ll continue assisting you throughout your Medicare journey—reviewing your plans each year to ensure they remain the best fit and answering any questions you may have along the way.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Why was Medicare established?

Medicare was created to offer healthcare benefits to retirees. Before its introduction, retirees who lost employer-sponsored coverage had few health insurance options.

How can I check if I'm enrolled in Original Medicare?

To see if you're enrolled in Original Medicare, check your Social Security check deductions. If you're receiving Social Security benefits, you're automatically enrolled at 65, and Medicare premiums are deducted from your benefits. You can also verify your enrollment online at MyMedicare.gov or by calling the Social Security Administration.

At what age can I get Medicare?

People receiving disability benefits for 24 months qualify for Medicare at any age, as do those with ESRD or ALS. Otherwise, Medicare eligibility begins at 65.

Who does not qualify for Medicare?

To qualify for Medicare, individuals must be U.S. citizens or have lived in the U.S. for at least five years. Those under 65 without disabilities, ESRD, or ALS are not eligible.

What documents are required for a Medicare application?

You must provide proof of U.S. citizenship or legal residency, along with your birth certificate and driver's license.

Do I need a primary care physician for Medicare?

No, you don't need to select a primary care physician with Original Medicare. However, choosing providers who accept Medicare assignment can help minimize your out-of-pocket costs.

Do I have to get a referral to see a specialist if I’m on Medicare?

No, you don’t need a referral to see a specialist. However, your out-of-pocket costs will be lower if you choose a specialist that accepts Medicare assignment.

Why was Medicare established?

Medicare was created to offer healthcare benefits to retirees. Before its introduction, retirees who lost employer-sponsored coverage had few health insurance options.

How can I check if I'm enrolled in Original Medicare?

To see if you're enrolled in Original Medicare, check your Social Security check deductions. If you're receiving Social Security benefits, you're automatically enrolled at 65, and Medicare premiums are deducted from your benefits. You can also verify your enrollment online at MyMedicare.gov or by calling the Social Security Administration.

At what age can I get Medicare?

People receiving disability benefits for 24 months qualify for Medicare at any age, as do those with ESRD or ALS. Otherwise, Medicare eligibility begins at 65.

Who does not qualify for Medicare?

To qualify for Medicare, individuals must be U.S. citizens or have lived in the U.S. for at least five years. Those under 65 without disabilities, ESRD, or ALS are not eligible.

What documents are required for a Medicare application?

You must provide proof of U.S. citizenship or legal residency, along with your birth certificate and driver's license.

Do I need a primary care physician for Medicare?

No, you don't need to select a primary care physician with Original Medicare. However, choosing providers who accept Medicare assignment can help minimize your out-of-pocket costs.

Do I have to get a referral to see a specialist if I’m on Medicare?

No, you don’t need a referral to see a specialist. However, your out-of-pocket costs will be lower if you choose a specialist that accepts Medicare assignment.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.