What are Medicare Supplements

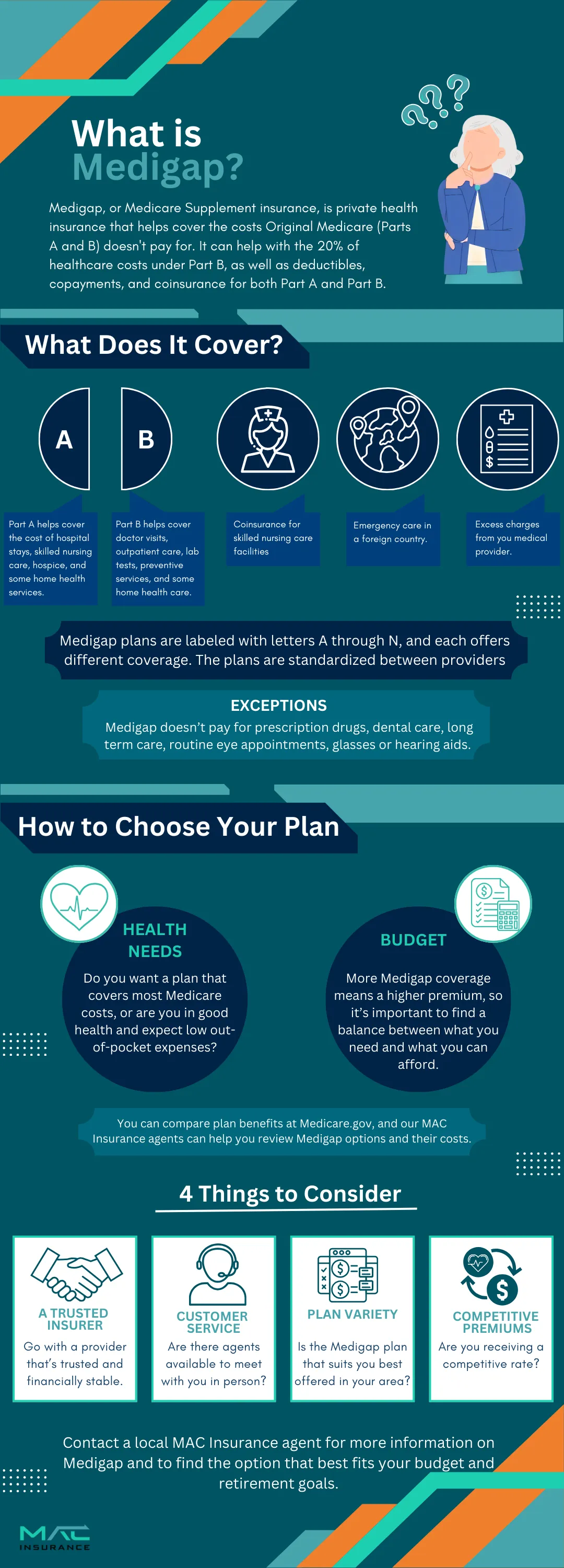

Medicare Supplements, also known as Medigap plans, are additional insurance policies designed to work alongside Original Medicare (Parts A and B). These plans help cover out-of-pocket costs that Original Medicare doesn’t fully pay for.

Here’s a brief overview of what Medicare Supplements are and how they can benefit you:

1. Purpose of Medicare Supplements

Cost Coverage: Medigap plans help cover various out-of-pocket expenses such as copayments, coinsurance, and deductibles that are not fully covered by Original Medicare. This can help reduce your overall healthcare costs.

Standardized Plans: Medicare Supplement plans are standardized and regulated by the federal government. They are offered in various plan types, each providing a different set of benefits. The plans are labeled with letters (e.g., Plan F, Plan G, Plan N) and the benefits are consistent across different insurance companies.

2. Key Features of Medicare Supplements

Wide Acceptance: Medigap plans are accepted by any healthcare provider that accepts Medicare. This gives you flexibility and freedom to choose your healthcare providers.

Additional Benefits: Some plans offer additional benefits that may not be covered by Original Medicare, such as foreign travel emergency coverage.

Premiums: Medigap plans require a monthly premium in addition to the premiums you pay for Medicare Part B. Premiums vary based on the plan type, insurance company, and your location.

3. How to Choose a Medigap Plan

Compare Plans: Review the different Medigap plan options to determine which one best fits your needs and budget. Each plan offers a different level of coverage.

Check Costs: Compare the costs of premiums and any potential out-of-pocket expenses. Keep in mind that the level of coverage varies by plan type.

Understand Enrollment: The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period, which starts when you are 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed acceptance without medical underwriting.

What are the 10 Medigap Plans?

Medicare Supplement plans, commonly known as Medigap, are designed to help cover the out-of-pocket costs that Original Medicare (Parts A and B) doesn’t cover. These plans are standardized and regulated by the federal government, and they come in different types, labeled A through N.

Here’s a brief overview of the 10 Medigap plans:

Coverage: Covers Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. It also covers Part B coinsurance or copayments and the first 3 pints of blood needed for a medical procedure.

Excludes: Part A and B deductibles, skilled nursing facility care coinsurance, and foreign travel emergency care.

Coverage: Includes all benefits of Plan A plus the Medicare Part A deductible.

Excludes: Part B deductible, skilled nursing facility care coinsurance, and foreign travel emergency care.

Coverage: Includes all benefits of Plan B, plus coverage for the Medicare Part B deductible and foreign travel emergency care.

Excludes: Plan C is not available to new Medicare beneficiaries who became eligible after January 1, 2020.

Coverage: Includes all benefits of Plan B, plus coverage for the Medicare Part B deductible.

Excludes: Skilled nursing facility care coinsurance and foreign travel emergency care.

Coverage: Offers comprehensive coverage, including all benefits of Plan D, and also covers the Medicare Part B deductible.

Excludes: Plan F is not available to new Medicare beneficiaries who became eligible after January 1, 2020.

Coverage: Includes all benefits of Plan F, except the Medicare Part B deductible.

Excludes: Part B deductible. Plan G is available to new Medicare beneficiaries.

Coverage: Covers 50% of the Medicare Part A deductible, 50% of Part B coinsurance or copayments, and 50% of the skilled nursing facility care coinsurance. It also covers the first 3 pints of blood needed for a medical procedure.

Excludes: Part B deductible, foreign travel emergency care, and some out-of-pocket expenses.

Coverage: Covers 75% of the Medicare Part A deductible, 75% of Part B coinsurance or copayments, and 75% of the skilled nursing facility care coinsurance. It also covers the first 3 pints of blood needed for a medical procedure.

Excludes: Part B deductible, foreign travel emergency care, and some out-of-pocket expenses.

Coverage: Covers 50% of the Medicare Part A deductible, all Part B coinsurance or copayments, and foreign travel emergency care. It also covers the first 3 pints of blood needed for a medical procedure.

Excludes: Medicare Part B deductible and skilled nursing facility care coinsurance.

10. Medigap Plan N

Coverage: Covers Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up, all Part B coinsurance or copayments, and foreign travel emergency care. It also covers the first 3 pints of blood needed for a medical procedure.

Excludes: Part B deductible and Part B excess charges.

What do Medicare Supplements cover?

Medicare Supplements, also known as Medigap plans, are designed to help cover the out-of-pocket costs that Original Medicare (Parts A and B) does not fully pay for.

Here’s a breakdown of what Medigap plans generally cover:

Coinsurance and Hospital Costs:

Medigap plans help cover the Medicare Part A coinsurance and hospital costs, including the cost of hospital stays beyond the first 60 days, up to an additional 365 days after Medicare benefits are exhausted.

Deductibles:

Some Medigap plans cover the Medicare Part A deductible, which you must pay before Medicare starts to cover your hospital services.

Coinsurance or Copayments:

Medigap plans cover the Medicare Part B coinsurance or copayments, which is the portion of your medical costs that you are responsible for after Medicare pays its share.

Deductibles:

Certain Medigap plans also cover the Medicare Part B deductible, which is the amount you must pay out-of-pocket before Medicare starts to pay its share for covered services.

3. Additional Coverage

First 3 Pints of Blood:

Medigap plans cover the cost of the first 3 pints of blood needed for a medical procedure, which is not covered by Original Medicare.

Skilled Nursing Facility Care:

Some Medigap plans help cover coinsurance for skilled nursing facility care after the 20-day period covered by Medicare. Foreign Travel Emergency Care: Certain Medigap plans offer coverage for emergency care while traveling outside the U.S., up to a certain limit, which is not covered by Medicare.

4. Out-of-Pocket Costs

Copayments:

Medigap plans help cover copayments for services such as doctor visits and outpatient care.

Coinsurance:

They also cover coinsurance amounts for various services, reducing your out-of-pocket expenses.

5. Exclusions and Limitations

Vision and Dental Care: Medigap plans do not cover routine vision or dental care, such as eye exams, glasses, or dental cleanings.

Hearing Aids: Medigap plans typically do not cover hearing aids or hearing exams.

Long-Term Care: They do not cover long-term care, such as extended stays in a nursing home or assisted living facilities.

We learn everything about Medicare to help you find

the right plan for the coverage you need.

What is not covered by Medigap?

Although Medicare Supplement (Medigap) plans help cover out-of-pocket costs not included under Original Medicare (Parts A and B), they exclude coverage for certain services and expenses. Below is an overview of what Medigap plans generally do not cover:

Prescriptions

1. Prescription Drug Costs:

Medications: Medigap plans do not cover the cost of prescription medications. You will need a Medicare Part D plan to help with prescription drug expenses.

2. Medicare Part D Deductibles and Co-Pays:

Part D Costs: Medigap plans do not cover any out-of-pocket costs associated with Medicare Part D, such as deductibles, co-pays, or coinsurance for prescription drugs.

3. Drug Coverage Gaps:

Coverage Gap (Donut Hole): Medigap plans do not assist with costs incurred during the Medicare Part D coverage gap (also known as the "donut hole"), where beneficiaries may face higher out-of-pocket expenses for prescriptions.

4. Over-the-Counter Medications:

Non-Prescription Drugs: Medigap does not cover the cost of over-the-counter medications, even if they are recommended by a doctor.

5. Non-Covered Drugs:

Excluded Medications: Medigap plans do not cover prescription drugs that are not included in your Medicare Part D plan’s formulary (list of covered drugs). Coverage for specific drugs is determined by the Part D plan you choose.

6. Medication Management Services:

Pharmacy Services: Medigap does not cover additional pharmacy services such as medication therapy management or consultations.

Dental, Vision, and Hearing

1. Vision Care:

Routine Eye Exams: Medigap plans do not cover routine eye exams, eye tests, or vision correction services. Eyeglasses and Contact Lenses: Costs for prescription glasses and contact lenses are not covered.

2. Dental Care:

Routine Dental Services: Medigap plans do not cover routine dental care such as cleanings, exams, fillings, crowns, or other dental procedures.

Dentures: Costs for dentures or other dental appliances are not covered.

3. Hearing Care:

Hearing Aids: Medigap plans do not cover the cost of hearing aids or hearing aid fittings.

Hearing Exams: Routine hearing tests or exams are not covered by Medigap.

Long-Term Care

Medicare Supplement (Medigap) plans provide valuable assistance with out-of-pocket costs associated with Original Medicare (Parts A and B), but they do not cover long-term care.

Here’s what you need to know about what Medigap plans do not cover in terms of long-term care:

1. Nursing Home Care:

Extended Stays: Medigap plans do not cover costs for extended stays in nursing homes or other long-term care facilities. This includes both skilled nursing and custodial care, which are not covered under Medigap.

Custodial Care: Medigap does not cover custodial care, which includes help with daily living activities like bathing, dressing, and eating, if it is the only care you need.

2. Assisted Living:

Residential Care: Medigap plans do not provide coverage for assisted living facilities, which offer help with daily activities but are not considered medical care.

3. Long-Term Personal Care Services:

Personal Care: Services such as personal care assistants, home health aides, and other non-medical support services are not covered by Medigap.

4. Long-Term Care Insurance:

Separate Policies: Medigap does not include or substitute for long-term care insurance, which is specifically designed to cover extended care needs. Long-term care insurance policies must be purchased separately.

How Much Will I Save with a Medicare Supplement Plan?

The amount you can save with a Medicare Supplement (Medigap) plan varies based on several factors, including the specific Medigap plan you choose, your healthcare needs, and the insurance provider you select.

Here’s a breakdown of how Medigap plans can potentially lead to savings:

1. Reduced Out-of-Pocket Costs:

Coinsurance and Copayments: Medigap plans cover a significant portion of the out-of-pocket costs for Medicare Part A and Part B services, including coinsurance and copayments. This can lead to substantial savings on hospital stays, doctor visits, and outpatient services.

Deductibles: Some Medigap plans cover Medicare Part A and/or Part B deductibles, which can help reduce your out-of-pocket expenses when you need care.

2. Predictable Costs:

Fixed Premiums: Medigap plans typically have fixed monthly premiums, which can help you budget more effectively. Knowing that most out-of-pocket expenses are covered can provide peace of mind and financial predictability.

3. Preventing Large Medical Bills:

Coverage for Gaps: Medigap plans help cover the gaps left by Original Medicare, such as excess charges and additional hospital costs. By covering these expenses, Medigap can protect you from unexpected and potentially large medical bills.

4. Cost Savings on Specialized Services:

Foreign Travel Emergency Care: Some Medigap plans include coverage for emergency medical care while traveling abroad, which can be a valuable benefit if you travel frequently.

5. Standardized Benefits:

Consistent Coverage: Medigap plans are standardized, meaning the benefits for each plan type are the same across all insurance companies. This allows you to compare plans and choose one that offers the best value for your needs.

6. Factors Influencing Savings:

Plan Type: The level of coverage provided by each Medigap plan varies. Plans with more comprehensive coverage (e.g., Plan F or Plan G) typically have higher premiums but offer more extensive benefits.

Location and Age: Premiums can vary based on where you live and your age. Shopping around and comparing plans in your area can help you find the best rates.

7. Personal Savings Example:

Example Scenario: For instance, if you frequently need medical care and have high coinsurance or deductible costs, a Medigap plan that covers these expenses can lead to significant savings. Conversely, if you have relatively low medical costs, a plan with lower coverage may offer fewer savings.

Medicare Supplement Frequently Asked Questions

Here’s a look at some commonly asked questions about Medicare Supplement plans:

Will my doctor accept my Medicare Supplement?

Yes! If your doctor accepts Medicare, they will also accept your Medigap plan. Medigap plans don’t rely on provider networks.

Can a company increase my rates if I file claims?

No, it is illegal for health insurance companies to raise your rates based on claims you’ve filed. They also cannot cancel your coverage due to frequent claims. Typically, Medigap premiums increase due to age or economic inflation.

Which Medicare Supplement offers the best coverage?

The ideal Medigap plan for you depends on your healthcare needs and budget. For minimal out-of-pocket expenses, Plan F is a top choice. However, Plan G provides nearly identical benefits and could offer cost savings.

Are Medicare Supplement plans better than Medicare Advantage plans?

It depends on your preferences and healthcare requirements. Medicare Supplements and Medicare Advantage plans function differently, so it’s important to compare their features and select the option that suits you best.

Do Medigap plans cover dental services?

No, Medicare Supplement plans do not cover dental services, except in rare cases. For dental coverage, a separate dental insurance plan is needed.

How much do Medicare Supplement plans cost?

The cost of a Medigap plan depends on factors like the plan you select, your age, gender, and location. Plans with broader coverage, such as Plans F and G, tend to have higher premiums. Additionally, older individuals generally pay more than younger ones.

No matter your budget, there is a plan for you!

The best part is, we will help you for free!

No matter your budget,

there is a plan for you!

The best part is,

we will help you for free!

Medicare Supplements

Deciding a

MEDICARE SUPPLEMENT

Plenty of plan information is available online, but for an accurate quote, a licensed Medicare agent can help. Rather than contacting each insurance carrier individually, we compare premiums from multiple providers to find you the best rate. Your premium depends on your details and health history, so we’ll need some information to provide quotes—but our services are completely free!

ADDITIONAL QUESTIONS TO BE ADVISED ON:

What is Medicare Supplement insurance?

Medigap plans, also called Medicare Supplement or Medicare Gap insurance, help cover the out-of-pocket costs that Original Medicare doesn’t pay.

When can you sign up for a Medicare Supplement plan?

Once enrolled in Medicare Parts A and B, you can sign up for a Medigap plan. You have a 6-month window from your Part B start date with guaranteed acceptance, meaning no health questions. After this period, approval may require medical underwriting.

How does Medicare Supplement insurance work?

Medicare Supplement plans act as secondary insurance to Original Medicare, covering some or all remaining costs from Parts A and B, depending on the plan chosen.

Are there any no-cost Medicare Supplement plans?

Medicare Supplement plans are not free; each requires a monthly premium. Some Medicare Advantage plans may have no premiums, but they come with limitations and don’t offer the same comprehensive coverage as Medigap.

Can I have both a Medicare Supplement and a Medicare Advantage plan or two Medicare Supplement plans?

No, you can have either a Medicare Supplement plan or a Medicare Advantage plan, but not both.

Will my doctor accept my Medicare Supplement plan?

If a provider accepts Medicare assignment, they must also accept your Medicare Supplement plan.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.