Medicare Supplement Insurance Companies

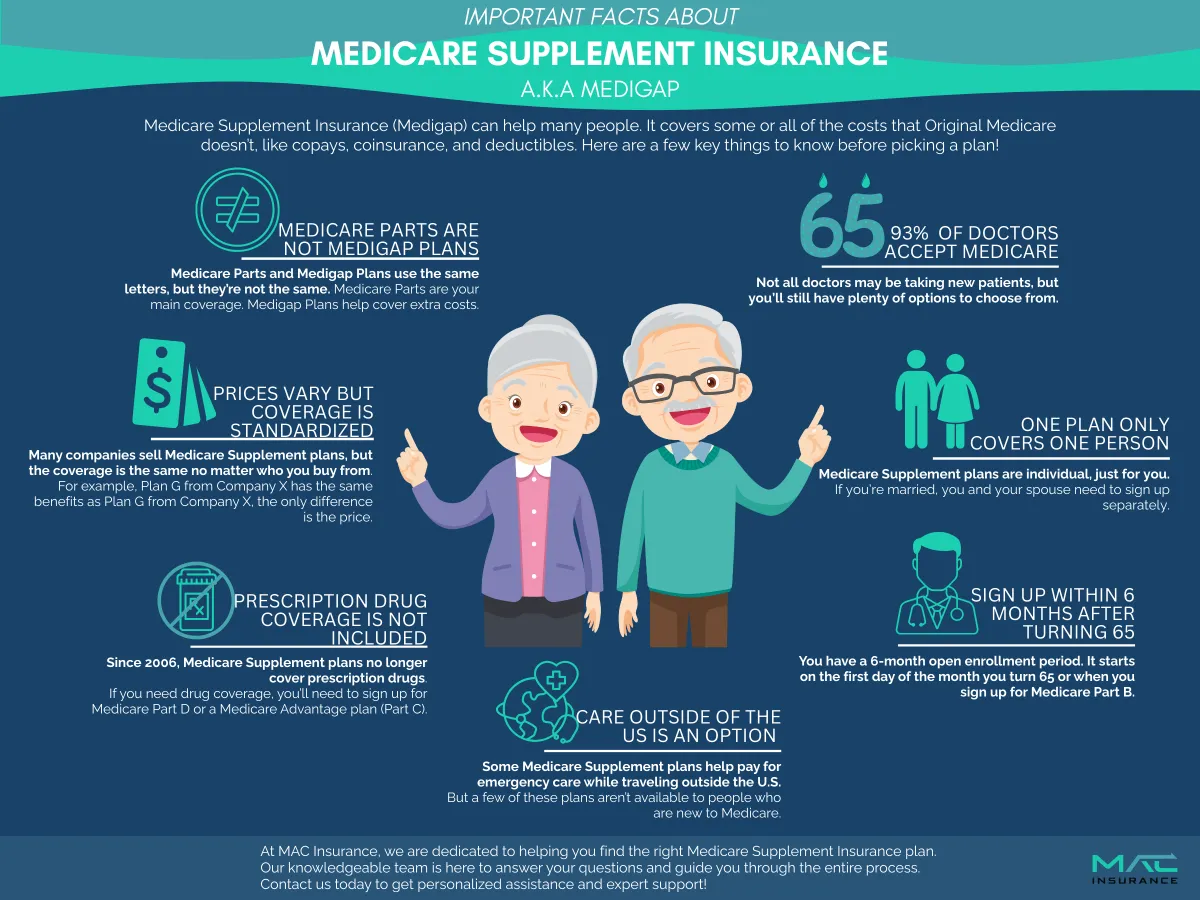

Medicare Supplement plans are sold by private insurance companies approved by Medicare. Each plan offers the same standardized benefits, regardless of the insurer—the only difference is the cost.

When choosing a Medigap plan, it’s important to consider the insurance company offering the coverage. Although the benefits for each standardized Medigap plan (A through N) are consistent across all providers, premiums and additional features can differ between companies.

An independent agent, like those at MAC Insurance, can compare multiple companies to find the best rates for you, saving you time and effort.

How to Choose the Right Medigap Insurance Company

Selecting the right Medigap provider is important because while benefits are standardized, pricing, customer service, and additional perks can vary. Here’s a look at some top insurance companies and what they offer:

● UnitedHealthcare (UHC) – A well-established provider with a wide range of Medigap plans and strong nationwide coverage, making it a reliable choice for many.

● Aetna – Offers competitive premiums and various plan options, with a strong focus on customer support and affordability.

● Cigna – Provides Medigap plans with affordable premiums and extra customer benefits, making it an attractive option for budget-conscious individuals.

● Humana – Features a variety of Medigap plans at different price points, plus strong customer service options for personalized support.

● Physician's Mutual – Covers a range of Medigap plans and includes preventive care benefits that Medicare typically does not cover.

When choosing a provider, consider factors like pricing, customer service reputation, ease of claims processing, and any added benefits that may be important to you.

No matter your budget,

there’s a plan that fits your needs!

And the best part?

Our help is completely free!

No matter your budget,

there’s a plan that fits your needs!

And the best part? Our help is completely free!

Choosing a Medicare Supplement Insurance Company

When selecting a Medigap provider, consider these key factors:

● Reputation & Customer Service – Check reviews and ratings to see how well the company handles claims and customer support.

● Financial Stability – Choose a company with strong financial ratings (A.M. Best, Moody’s) to ensure they can pay claims long-term.

● Premium Costs – Compare prices for the same plan since costs vary by company. Look for discounts on auto-pay, non-smokers, or couples.

● Extra Benefits – Some insurers offer perks like wellness programs, telehealth, or discounts on vision and hearing.

Finding the right provider ensures reliable coverage at a fair price.

Understanding Financial Ratings

When choosing a Medicare Supplement insurance provider, financial ratings play a crucial role in determining the reliability and long-term stability of the company. These ratings help assess whether the insurer can consistently pay claims and maintain financial health over time.

Why It Matters

● Stability & Reliability – Insurers with strong financial ratings are less likely to face financial struggles, ensuring they can pay claims promptly and remain in business for the long haul.

● Peace of Mind – A financially secure company guarantees that your policy remains valid and that your benefits will be available when you need them.

● Premium Stability – While all insurance premiums can rise over time, companies with solid financial backing tend to have more predictable and gradual increases, avoiding sudden spikes.

● Avoiding Risk – Insurers with low financial ratings may face regulatory issues, delays in claims processing, or, in extreme cases, bankruptcy—leaving policyholders scrambling for new coverage.

Why Good Customer Service Matters in Medigap Insurance

● Smooth Claims Process – A responsive insurer ensures claims are processed quickly and efficiently, minimizing delays and frustrations.

● Clear Communication – Good customer service means easy-to-understand policy details, quick answers to questions, and transparency about coverage.

● Help with Enrollment – A supportive team can guide you through choosing a plan, completing paperwork, and meeting deadlines.

● Billing & Payment Support – Reliable service ensures accurate billing, flexible payment options, and quick resolution of any issues.

● Ongoing Assistance – Quality insurers provide continuous support, keeping you informed about policy updates and answering your concerns whenever needed.

● Peace of Mind – Knowing you can reach a helpful team reduces stress and makes managing your coverage hassle-free.

● Check Reviews – Look at customer ratings and feedback to ensure the insurer has a solid reputation for service.

Saving on Medigap Premiums

● Same Coverage, Different Prices – Medigap benefits are standardized, but premiums vary by insurer. Finding the best price is key.

● Use a Broker – Independent brokers compare prices across multiple companies to find the most affordable, reputable option.

● Unlock Discounts – Insurers offer discounts for things like annual payments or linking an activity device. A broker can help you find what applies to you.

Medigap Rate Increases

Medicare Supplement premiums go up each year, but some companies raise rates more than others. To avoid big jumps in cost, check the company’s history. Do they keep increases reasonable, or are they known for frequent, steep hikes?

Medicare Supplement Companies We Work With

We partner with both well-known and lesser-known insurance companies that offer strong financial ratings and competitive premiums. Some of the insurers we work with include:

● UnitedHealthcare

● Aetna

● Cigna

● Humana

● Physician's Mutual

● Anthem

These companies provide the same Medigap coverage, often at more affordable rates.

Medicare Supplement

Guide to Choosing a

MEDICARE SUPPLEMENT INSURANCE COMPANIES

Several private insurance companies offer Medicare Supplement (Medigap) plans, but availability and pricing vary by location. Each company offers standardized Medigap plans, meaning coverage remains the same across insurers, but premiums, customer service, and additional perks may differ.

Selecting a Medicare Supplement insurance company requires careful consideration. Our knowledgeable agents can help you find a plan that fits your needs and budget.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Which insurance companies are the most trusted for Medigap plans?

Top trusted Medigap companies include AARP/UnitedHealthcare, Mutual of Omaha, Aetna, Cigna, and Anthem Blue Cross Blue Shield. They offer reliable coverage, good customer service, and competitive pricing.

How often do Medigap insurance companies increase premiums?

Medigap premiums can increase annually due to factors like inflation, age, and company pricing methods (community-rated, issue-age, or attained-age). The frequency and amount vary by insurer and state.

Will my Medigap policy stay the same if I move to a different state?

Yes, your Medigap policy will stay the same if you move to a different state, but premium costs may change based on your new location. Some states may also have different plan availability.

How do I check a Medigap company’s financial strength and ratings?

You can check a Medigap company’s financial strength and ratings by looking at reports from agencies like AM Best, Moody’s, or Standard & Poor’s. You can also visit the Better Business Bureau (BBB) or check customer reviews on Medicare.gov and insurance websites.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.