Part D Estimated Costs

Medicare Part D includes all prescription drug plans available to people with Original Medicare (Parts A and B). Understanding the costs can be tricky.

Besides the monthly premium, you’ll also need to think about deductibles, coinsurance, and different coverage phases. Figuring out your Part D costs can be challenging, but we’re here to help you understand the key details.

Part D Premiums

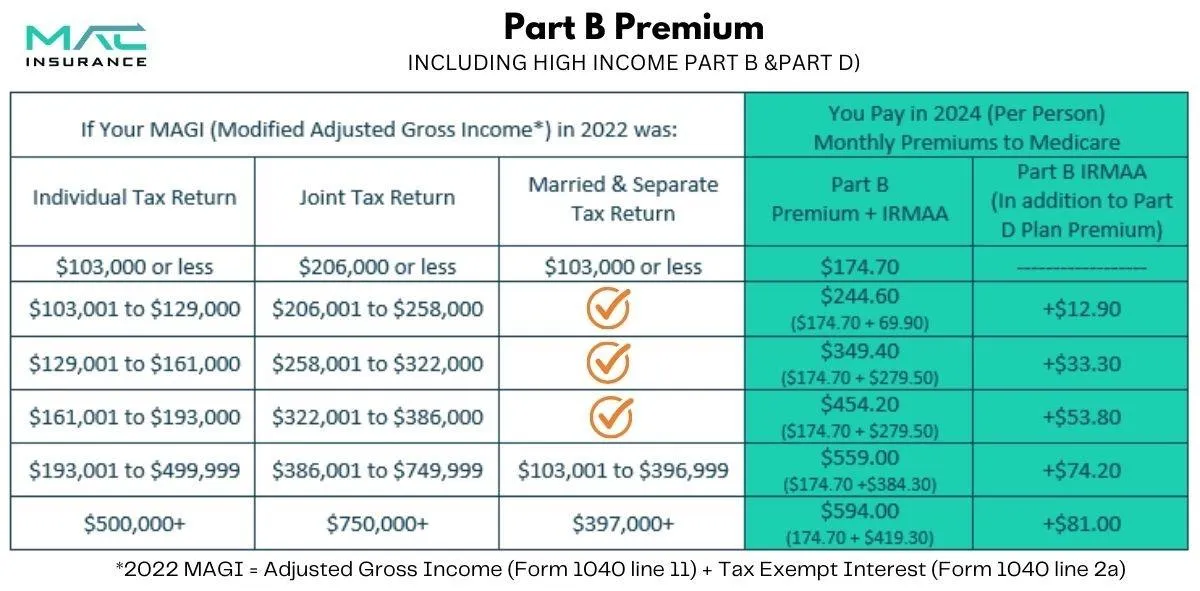

Your income can affect your Part D premium. If you earn above a certain amount, you may have to pay an extra fee called the Income-Related Monthly Adjustment Amount (IRMAA). This applies to both your Part B and Part D premiums.

Social Security looks at your income from two years ago to decide if you owe IRMAA. For example, your 2025 IRMAA is based on your 2022 income. There are different income levels with different extra charges, and these amounts change each year.

Income-Related Monthly Adjustment Amounts for Part D

Your income can affect your Part D premium. If you make more than a certain amount, you’ll have to pay an extra fee called the Income-Related Monthly Adjustment Amount (IRMAA). This fee is added to both your Part B and Part D premiums.

Social Security looks at your income from two years ago to decide if you owe IRMAA. For example, your 2025 IRMAA is based on your 2022 income. There are different income levels with different extra charges, and these amounts change each year.

If you are required to pay IRMAA, it will be added to your monthly premium. However, the payment is directed to the Medicare program, not the insurance carrier you enroll with.

Part D Late Enrollment Penalties

Another thing that can make your Part D premium higher is the late enrollment penalty. This is one of the most common Medicare penalties.

If you don’t sign up for Part D when you’re first eligible, you’ll have to pay this penalty—even if you don’t take any medications!

The penalty is 1% of the national base premium ($34.70 in 2024) for every month you went without Part D. That amount is then added to your monthly premium.

For example, if you waited 24 months to enroll, your penalty would be $8.10 per month. This fee stays with you for life or as long as you have a Part D plan.

Part D Deductibles

The deductible is an important part of Medicare Part D. It’s the amount you pay for your prescriptions before your plan starts covering the cost.

Each year, Medicare sets a standard deductible. In 2025, the maximum deductible is $590, but some plans may offer a lower amount.

A plan with a low deductible might sound good, but it could have higher monthly premiums or other costs. Also, many plans don’t apply the deductible to lower-tier drugs, so common generic medications may not count toward it.

If you qualify for Extra Help, a program for people with limited income, your deductible may be lower or even waived.

Part D Coinsurance Costs

Once you’ve paid your deductible, your Part D plan will start sharing the cost of your prescriptions. This is called the initial coverage phase.

During this phase, you’ll pay a coinsurance or copay for each medication. The amount depends on your plan and where the drug falls on the formulary (the list of covered drugs).

Lower-tier drugs, like common generics, usually cost less. Higher-tier drugs, including name-brand and specialty medications, are more expensive.

The Coverage Gap or Donut Hole

The donut hole is a coverage gap in Medicare Part D (prescription drug coverage). It’s the phase where you might have to pay a higher share of medication costs after reaching a certain spending limit.

Starting in 2025, there will be a $2,000 out-of-pocket cap on covered prescription drugs. Here’s how the process works:

● Initial Coverage Phase – Starting in 2025, there will be a $2,000 out-of-pocket cap on covered prescription drugs. Here’s how the process works:

● Donut Hole (Coverage Gap) – Previously, this phase required beneficiaries to pay 25% of drug costs. However, with the new $2,000 cap, once your out-of-pocket spending (including payments made on your behalf) reaches $2,000, you automatically move to the next phase.

● Catastrophic Coverage – Once you hit the $2,000 cap, you will no longer have to pay out-of-pocket for covered Part D drugs for the rest of the year.

This new policy effectively eliminates the financial burden of high drug costs by capping what you pay. To ensure your plan covers your medications, consider reviewing and comparing plans during Medicare Open Enrollment (October 15 – December 7).

New for 2025: $2,000 cap on covered Part D drugs

Starting in 2025, all Medicare plans will include a $2,000 cap on what you pay out-of-pocket for prescription drugs covered by your plan. If your out-of-pocket spending on covered drugs reaches $2,000 (including certain payments made on your behalf, like through the Extra Help program), you’ll automatically get “catastrophic coverage.” That means you won’t have to pay out-of-pocket for covered Part D drugs for the rest of the calendar year.

As with the deductible, if you are enrolled in Extra Help, you won’t need to worry about the coverage gap.

Saving Money on Prescription Medications

Medicare Part D helps lower prescription drug costs, but there are other ways to save even more. Here are some simple tips:

Choose Generic Medications: Generic drugs are usually much cheaper than name brands and are often placed in lower-cost tiers. Ask your doctor if a generic option is available.

Review Your Plan Every Year: Medicare plans change yearly, so check your options during the Annual Election Period (Oct. 15 – Dec. 7) to make sure you’re still getting the best deal.

Apply for Extra Help: If you have a limited income, you may qualify for a program that helps cover medication costs. Contact your state’s Medicaid office to see if you’re eligible.

Check for Manufacturer Discounts: Some drug companies offer financial assistance for their medications. Visit the manufacturer’s website or ask your doctor.

Look Into State Assistance Programs: Some states offer programs to help with drug costs. See if your state has one.

Consider Mail-Order Pharmacies: Many Part D plans offer a mail-order option, which can save money and time compared to picking up prescriptions at a pharmacy.

Use Prescription Discount Programs: Programs like GoodRx, SingleCare, or Cost Plus Drugs can sometimes offer lower prices than your insurance. Some pharmacies, like Walmart and Kroger, also have their own discount programs.

Quickly Estimate Your Part D Costs

Medicare Part D can feel confusing, but you don’t have to figure it out alone. The advisors at MAC Insurance make the process simple.

We use helpful tools to estimate your costs and find the most budget-friendly Part D plan for your needs. Our calculators can show:

Which medications count toward your deductibleWhen you might enter the coverage gapHow much you may spend on prescriptions throughout the year

Our experienced agents are here to help you find the best plan at the lowest cost. Call us today to compare Part D plans in your area and get expert guidance!

Medicare Part D

Enrolling in

MEDICARE PART D

Choosing a Part D plan involves many factors, but you don’t have to do it alone! Our agents will compare plans from multiple carriers to help you find the best coverage at the best price.

Once you’ve selected a plan, the enrollment process is straightforward. We’ll handle the paperwork, assist with setting up your premium payments, and submit the application for you. Keep in mind that plans can change each year, so we’ll review your coverage annually to ensure you continue to have the best option available.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

What factors influence the cost of Medicare Part D plans?

Medicare Part D costs depend on the plan’s premium, deductible, drug coverage, pharmacy choice, and coverage phase. Prices may change yearly, and assistance programs can help lower costs.

What is the catastrophic coverage threshold, and how does it impact expenses?

The catastrophic coverage threshold is the point where you’ve spent enough on drugs that Medicare helps more with costs. After reaching it, you pay only a small amount for your medications for the rest of the year.

How do different Part D plans cover generic vs. brand-name drugs?

Medicare Part D plans usually charge less for generic drugs and more for brand-name drugs, with costs depending on the plan’s drug list and tier system.

What cost-saving programs or assistance options are available for Part D beneficiaries?

Part D beneficiaries may qualify for cost-saving programs like Extra Help, state pharmaceutical assistance programs (SPAPs), manufacturer discounts, and Medicare Savings Programs, which can lower premiums, deductibles, and drug costs.

Do costs vary depending on whether a pharmacy is in-network or out-of-network?

Yes, costs are usually lower at in-network or preferred pharmacies, while out-of-network pharmacies may have higher copays or may not be covered at all.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.