Parts of Medicare

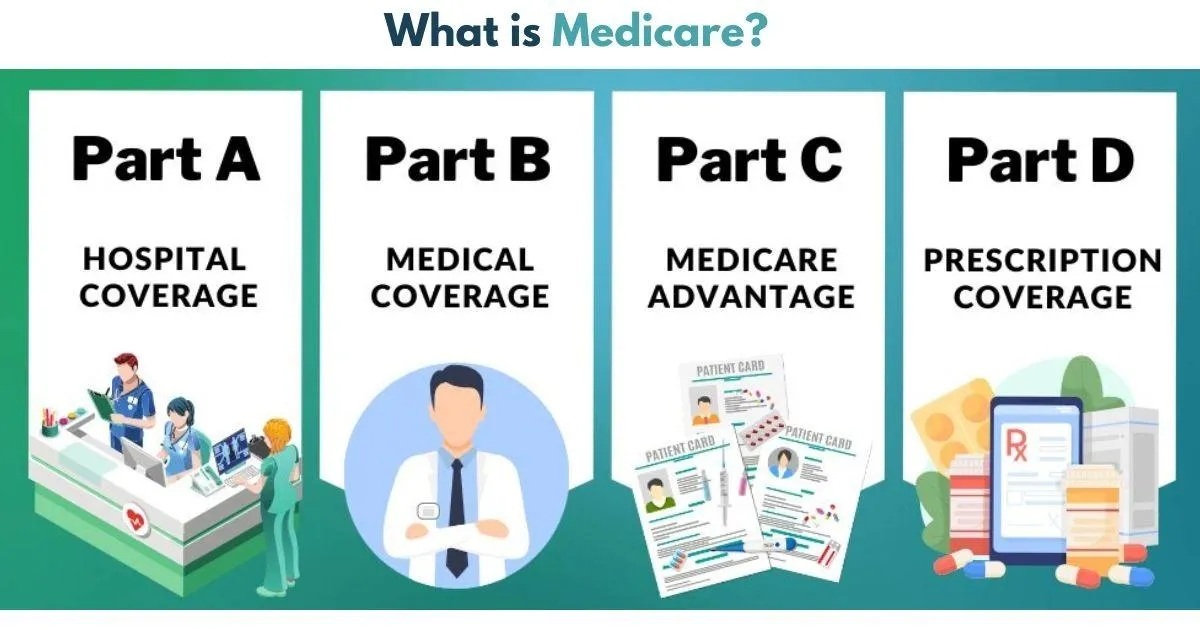

Medicare works differently from other health insurance. Instead of one plan that covers everything, it consists of several parts that work together to provide comprehensive medical coverage.

There are four parts of Medicare. While you don't have to enroll in all four, it's important to understand what each part offers so you can make an informed decision about which ones best meet your needs.

Medicare has four parts:

● Part A: Inpatient hospital coverage

● Part B: Outpatient medical coverage

● Part C: Medicare Advantage, an alternative to Parts A and B

● Part D: Prescription drug coverage.

Medicare Part A

Medicare Part A, also called hospital insurance, helps pay for hospital stays, skilled nursing care, hospice care, and some home health care.

Here’s what it covers:

Hospital stays – Covers up to 90 days per benefit period, plus 60 extra lifetime days if needed.

Skilled nursing care – Covers up to 100 days if you were in the hospital for at least three days and need ongoing medical care.

Home health care – Covers some in-home care if you had a hospital stay of at least three days.

Hospice care – Covers end-of-life care if a doctor certifies it's needed.

Most people get Part A for free if they or their spouse worked and paid taxes for at least 10 years. If not, you can still buy it, but the cost depends on how long you’ve paid taxes.

Medicare Part B

Medicare Part B, also called medical insurance, helps pay for doctor visits, preventive care, medical equipment, and some treatments.

Here’s what it covers:

Doctor visits and treatments – Covers medically necessary care from doctors and specialists.

Medical equipment – Helps pay for wheelchairs, walkers, oxygen tanks, and other equipment for home use.

Home health care – Covers some home health services if you don’t qualify under Part A.

Ambulance services – Pays for emergency transport and some non-emergency rides when medically needed.

Preventive care – Includes screenings, vaccines, and therapy services like physical and speech therapy.

Lab tests and X-rays – Covers necessary blood tests and diagnostic imaging.

Chiropractic care – Covers treatment only for spinal misalignment (subluxation).

Certain prescription drugs – Covers some medications, such as cancer treatments and injections given by a doctor.

Part B has a monthly premium that changes yearly, with higher costs for people with higher incomes. It also has an annual deductible, and Medicare generally pays 80% of covered services, leaving you to pay the remaining 20%.

Medicare Part C

Medicare Part C, also called Medicare Advantage, is a private insurance plan that covers everything in Medicare Parts A and B, plus extra benefits.

Here’s what you need to know:

It’s run by private insurance companies that work with the government.

It includes all Medicare-covered services but may also offer extra benefits like dental, vision, hearing, gym memberships, prescription drug coverage, transportation, and meal delivery.

Many plans have low or even $0 premiums, but you still have to pay your Medicare Part B premium and other costs like copays and deductibles.

Since Medicare Advantage plans are from private insurers, benefits and costs vary, so it’s important to compare options before enrolling.

Medicare Part D

Medicare Part D helps pay for prescription drugs you get from a pharmacy. It’s offered by private insurance companies and can be a stand-alone plan or included in a Medicare Advantage plan with drug coverage (MAPD).

Here’s how it works:

● Each plan has a list of covered drugs (called a formulary). If your medication isn’t listed, you can request an exception, appeal, or pay out-of-pocket.

● Drugs are grouped into cost tiers – lower tiers include cheaper generic drugs, while higher tiers have more expensive name-brand and specialty medications.

● Medicare sets a yearly deductible, but some plans offer lower deductibles.

● Certain drugs must be covered, including HIV/AIDS treatments, antidepressants, seizure medications, cancer drugs, and most vaccines (with no cost-sharing).

Part D Coverage Phases

Your costs depend on which phase you’re in:

Deductible Phase – You pay the full cost until your plan’s deductible is met.

Initial Coverage Phase – You pay a set copay or percentage until you reach a spending limit.

Coverage Gap (Donut Hole) – You pay more for drugs until you reach a higher spending limit.

Catastrophic Coverage – You pay much less for the rest of the year.

Not everyone goes through all four phases, so it’s important to check with a Medicare advisor to estimate your yearly prescription costs.

Medicare Explained

Explore the Different

PARTS OF MEDICARE

Medicare is divided into four distinct parts. As you navigate your Medicare options, it's essential to understand how each part functions both on its own and in combination with the others.

Connect with a Medicare plan expert now to get personalized guidance and answers to your questions about coverage options.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Do I need all four parts of Medicare?

No, you don’t need all four parts. Most people get Part A (usually free) and Part B for medical coverage. Part C (Medicare Advantage) is an alternative to A & B with extra benefits. Part D helps with prescription drugs but is optional. If you have other insurance, you may not need certain parts right away.

How do I choose between Original Medicare and Medicare Advantage?

Choose Original Medicare for more doctor flexibility and the option to add drug coverage and a supplement plan. Choose Medicare Advantage for a bundled plan with extra benefits but with network limits. Pick what fits your needs and budget best.

What happens if I don’t enroll in Medicare when I’m first eligible?

If you delay enrolling in Medicare without other qualifying insurance, you may have to pay lifelong penalties, including higher premiums for Part A, a 10% yearly increase for Part B, and a 1% monthly increase for Part D.

Are there penalties for late enrollment in Medicare?

Yes, if you enroll late without other qualifying coverage, you may face penalties: Part A costs more if not free, Part B increases by 10% for each year delayed, and Part D adds 1% per month delayed without drug coverage.

How do Medicare Advantage plans differ from Medigap?

Medicare Advantage (Part C) is an all-in-one plan that replaces Original Medicare, often including extra benefits like dental and vision, but requires using a network of doctors.

Medigap (Medicare Supplement) works with Original Medicare to help pay out-of-pocket costs like deductibles and coinsurance but does not include extra benefits or drug coverage.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.