Medigap Plan A

Medigap Plan A, also called Medicare Supplement Plan A, helps cover the 20% of outpatient costs that Medicare doesn’t pay. It also covers Part B copayments and the first three pints of blood.

Every Medicare Supplement provider must offer Plan A, but it’s not the most popular choice. Many people pick it, but Plans F, G, or N usually offer better coverage.

Learn more about Medigap Plan F.

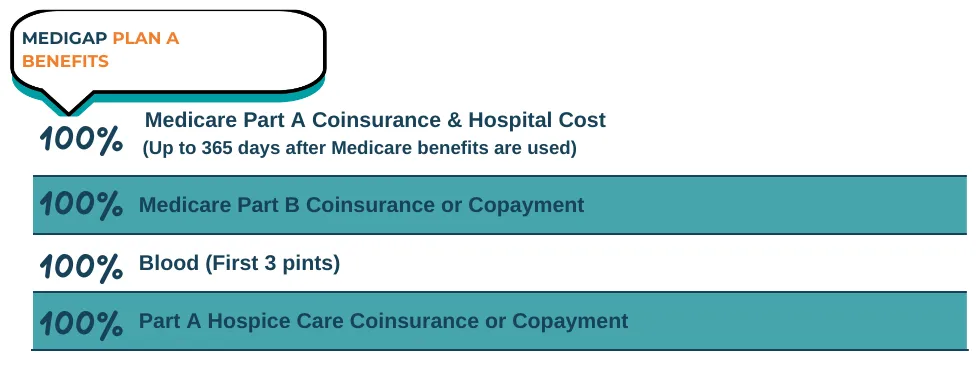

What is covered under Medicare Supplement Insurance Plan A?

Plan A has the fewest benefits of all Medicare supplement plans. It only covers the basic benefits that every Medigap plan must include.

In other words, this plan covers just the common things that are required by Original Medicare benefits.

Therefore, 100% of coverage includes:

● Part A coinsurance

● Hospital stay costs up to 365 days after Medicare benefits reach their limit

● Part B coinsurance or copayment

● First three blood prints

● Part A coinsurance and copayment for hospice care

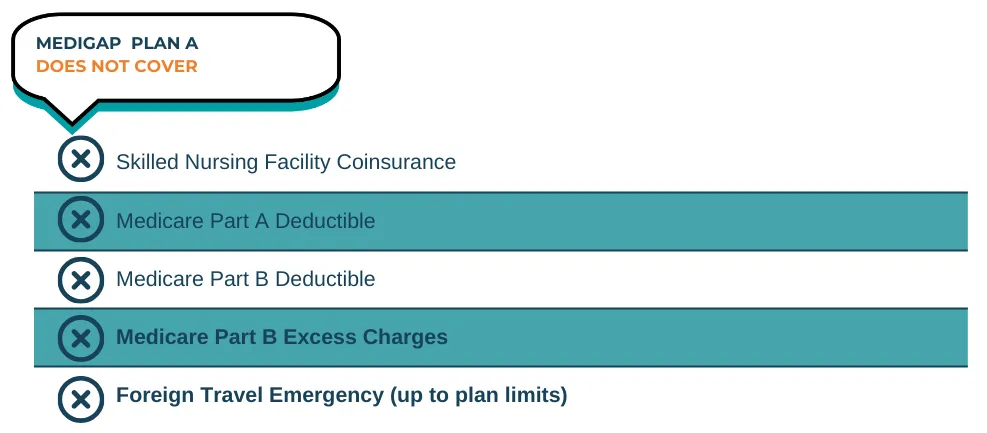

What is not covered by Medigap Plan A?

Plan A does not cover the deductibles for Medicare Part A or B, skilled nursing care coinsurance, Part B extra charges, or emergency care while traveling outside the U.S.

Plan A for Individuals Younger than 65

Not everyone under 65 on Medicare can get all supplement plans. In some cases, Plan A is the only choice, but it costs much more—sometimes two to three times higher—because younger Medicare beneficiaries often have higher medical expenses.

People on Social Security disability get another chance to enroll in a supplement plan without health questions when they turn 65. This allows them to switch to a different plan if they choose.

Medigap Plan A versus Medicare Part A

Medicare "parts" refer to benefits of Original Medicare, like Part A for hospital stays, while "plans" are Medicare supplements, like Plan A, which helps cover out-of-pocket costs such as copayments, coinsurance, and deductibles.

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN A

There’s a lot of information about each plan available online, but to get an accurate quote, you’ll need to work with a licensed Medicare agent. Instead of contacting each insurance carrier for a quote, we can compare premiums from multiple carriers to help you find the best rate.

We’ll need to gather some details from you to provide quotes, as your premium is influenced by your information and health history. The good news is that our services are completely free! If you choose to enroll in a Medigap plan through us, we also offer unlimited support. Whether you have questions about your coverage or need help understanding your plan, we’re here to assist you.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Which Medicare supplement plans include core benefits?

All Medicare supplement plans include core benefits, but only Plan A covers just the basic ones.

How much blood is covered under the core benefits?

Medigap core benefits cover the cost of the first three pints of blood.

Can I switch from Medigap Plan A to a different supplement plan later?

Yes, you can switch from Medigap Plan A to another supplement plan, but you may need to pass medical underwriting unless you're in a guaranteed issue period.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.