Medigap Plan G

Medigap Plan G is one of the most popular Medicare supplement plans. It provides comprehensive coverage, similar to Plan F, but is available to those who turned 65 after January 1, 2020. Since Plan F is no longer an option for new enrollees, Plan G is the best choice for nearly full coverage.

Why are there so many different Medigap Plan Letters?

Medigap plans were standardized in 1990 to make it easier for people to compare options. Before that, different states had complicated plans with extra riders that made choosing coverage confusing. Standardization ensured that each Medigap plan with the same letter (A, B, C, D, F, G, K, L, M, N) offers the same benefits, no matter which insurance company sells it.

Here’s why there are different Medigap plan letters:

1. Standardization – Every plan with the same letter offers the same benefits, making it easier to compare options.

2. Different Coverage Levels – People have different healthcare needs, so plans range from basic to more comprehensive coverage.

3. Cost Differences – Some plans have lower premiums with fewer benefits, while others cost more but cover more expenses.

4. Medicare Changes – Plans can be updated over time. For example, Plan C and Plan F were discontinued for new enrollees in 2020.

5. More Choices – Having multiple plans lets people pick the one that best fits their needs and budget.

Why is the Medigap Plan G so Popular?

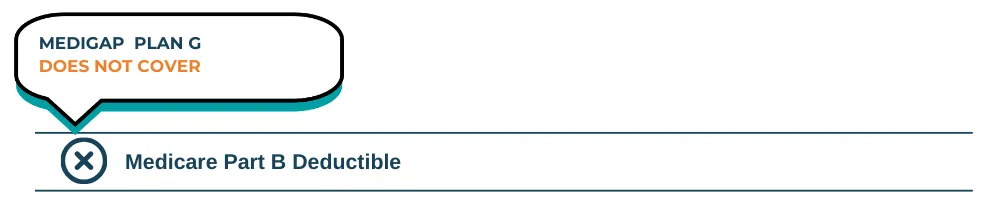

Medigap Plan G is popular because it offers almost full coverage, except for the Medicare Part B deductible. It became even more popular after Plan F was discontinued for new enrollees in 2020 under the MACRA law.

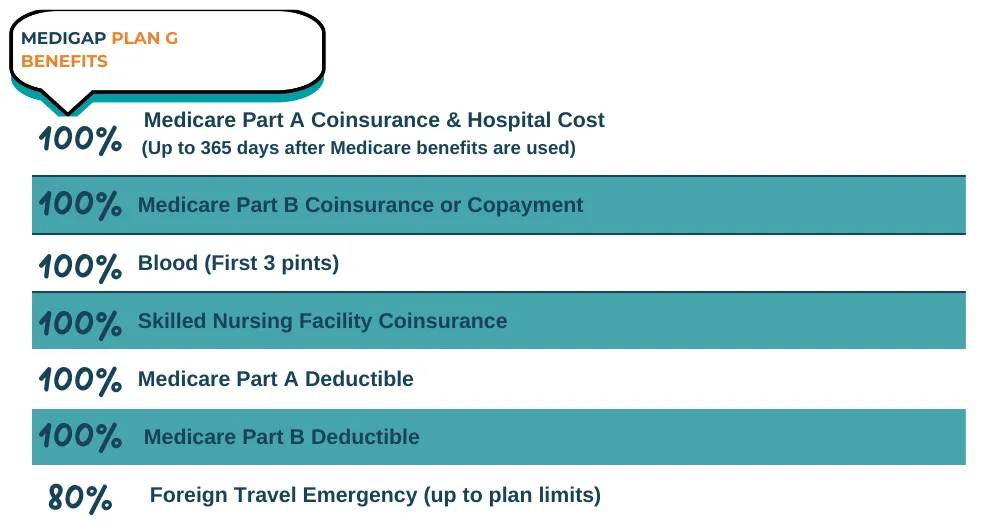

Here’s what Plan G covers:

● Medicare Part A costs – Includes the hospital deductible, daily hospital copays, and skilled nursing facility copays.

● Medicare Part B costs – Covers the 20% coinsurance that Medicare doesn’t pay (which has no limit) and any excess charges.

● Foreign travel emergencies – Helps with medical costs outside the U.S.

Plan G is a great choice for those who want strong coverage and predictable healthcare costs.

How did MACRA Affect Plan G?

Medicare Access and CHIP Reauthorization Act (MACRA) made changes to Medigap plans, affecting Plan G in a few ways. Since Plan F was discontinued for new Medicare enrollees after January 1, 2020, Plan G became the best option for full coverage (except for the Part B deductible). MACRA also introduced High-Deductible Plan G, which has lower monthly costs but a higher deductible. If you had Plan F before 2020, you could keep it, but new enrollees can no longer sign up, which may cause its price to increase over time. Because of these changes, Plan G is now the most popular Medigap plan.

Guaranteed Issue Rules with Medigap Plan G

Guaranteed issue rules are different from Medigap Open Enrollment and apply in specific situations, like losing employer coverage or leaving a Medicare Advantage plan. If you qualified for Medicare before January 1, 2020, Plan F was your guaranteed issue option. However, if you became eligible after that date, Plan G is now the main guaranteed issue choice in most cases.

Why is Guaranteed Issue Relevant for People who do not Qualify for it?

Guaranteed issue is important even for those who don’t qualify because it affects Medigap plan availability and pricing. Insurance companies must accept applicants without health questions during guaranteed issue periods, which can lead to higher overall premiums for certain plans. Since Plan G is now the main guaranteed issue option for new enrollees, its premiums may increase over time compared to other Medigap plans. Understanding these rules can help beneficiaries choose a plan that offers long-term stability.

Is Medigap Plan G the Greatest Value Medicare Supplement?

Medigap Plan G is often referred to as "G as in Greatest Value" by many brokers. While this title is subjective and dependent on individual circumstances, one thing is clear: Medigap Plan G is currently the only Medicare Supplement plan for those turning 65 that offers fully predictable out-of-pocket costs. Since the Part B deductible is relatively small and is the only out-of-pocket expense associated with Plan G, individuals with this coverage can expect minimal dissatisfaction with their potential costs. Other Medigap plans may have exposure to Excess charges, although many states have prohibited this practice

(see Medicare Overcharge Measure), and even in states without such laws, very few doctors engage in it. If minimizing out-of-pocket expenses is your goal, Medigap Plan G is the best choice.

Many people see Medigap Plan G as one of the best Medicare Supplement plans because it offers great coverage and benefits.

Here’s why:

1. Covers Most Costs – Plan G helps pay for hospital stays, doctor visits, skilled nursing care, and even emergency care when traveling abroad. It also covers extra charges from doctors who charge more than Medicare’s standard rate.

2. Predictable Costs – Since Plan G covers almost all medical expenses except for the small Part B deductible, your costs are easy to budget.

3. Choose Any Doctor – You can visit any doctor or specialist who accepts Medicare—no referrals or approvals needed.

4. No Network Limits – Unlike Medicare Advantage, Plan G lets you go to any hospital or provider that accepts Medicare, without worrying about networks.

5. Gained Popularity After 2020 – When Plan F stopped being available to new Medicare enrollees, Plan G became the go-to option for the most coverage.

6. Great Value – While Plan G’s premium may be higher than some basic plans, it often saves money in the long run, especially for those who need frequent medical care.

Which Medigap Plan G is Accepted by my Doctor?

All Medigap Plan G policies provide the same coverage, no matter which insurance company sells them. The key factor is whether your doctor accepts Medicare, not a specific Medigap plan. If your doctor accepts Medicare, they will also accept any Medigap Plan G from any provider. Just ask your doctor, “Do you accept Medicare?” If the answer is yes, your Medigap Plan G will work.

Medigap Plan G Versus Medicare Advantage

Medigap Plan G is one of the most comprehensive Medicare Supplement options available for new beneficiaries. While Medicare Advantage plans are heavily advertised and expanding in many areas, Medigap plans continue to grow in popularity as more people become eligible for Medicare.

To choose the best option, it's important to compare the pros and cons of each plan based on your healthcare needs, budget, and lifestyle.

Pros of Medigap Plan G:

● Most doctors and hospitals accept Medigap, allowing you to receive care anywhere Medicare is accepted, nationwide.

● Medigap Plan G covers almost all medications out of pocket.

Cons of Medigap Plan G:

● You will need to enroll in a separate stand-alone Part D Prescription Drug Plan.

● Medigap Plan G comes with a premium, which may increase over time.

● Medigap does not cover dental, vision, or hearing, so you may need to purchase a separate policy for these services.

Pros of Medicare Advantage:

● Medicare Advantage plans often offer premiums as low as $0 per month.

● Many plans include extra benefits like dental, vision, hearing, and over-the-counter allowances.

● Most Medicare Advantage plans also include prescription drug coverage.

Cons of Medicare Advantage:

● In 2025, Medicare Advantage plans have a maximum out-of-pocket limit of $9,350 for in-network care. If you use out-of-network providers, your costs could go up to $14,000.

● Network restrictions: You may need to use doctors and hospitals within the plan's network or pay more for out-of-network care.

● Prior authorization: Some services, like skilled nursing facility stays or home healthcare, may require approval from the plan before they are covered.

Both options have pros and cons. If a Medigap plan is too expensive or unavailable, a Medicare Advantage plan can be a good alternative since it limits out-of-pocket costs.

Why Might Someone not be able to get Medigap Plan G?

You may not be able to get Medigap Plan G if you apply outside your Open Enrollment Period, have certain health conditions, live in a state with restrictions, or are currently enrolled in a Medicare Advantage plan.

These instances are most commonly the following:

● Medigap Open Enrollment: This starts the month you turn 65 and lasts for six months. During this time, you can get any Medigap plan without worrying about your health history.

● Delaying Part B: If you wait to enroll in Medicare Part B (like after retiring), you get another six-month period from your Part B start date to buy a Medigap plan with no health questions.

● Guaranteed Issue Rights: If you lose other health coverage, you have 63 days to sign up for a Medigap plan without medical underwriting.

Medigap Guaranteed Issue State Rights: Some states have their own rules for guaranteed Medigap coverage, which can change over time.

If you don’t qualify for a guaranteed issue period, you’ll need to go through a simple health review. This may include answering medical questions, sharing prescription details, and having an insurance company assess your eligibility. If you don’t pass, you might not be able to get Medigap Plan G. That’s why signing up during a guaranteed issue period is the best way to secure coverage.

Medigap Plan G and Disability Medicare

If you qualify for Medicare because of a disability, getting a Medigap Plan G may be harder due to state-specific rules. These restrictions vary by location and can be unpredictable.

If you weren’t able to enroll in Medigap Plan G or didn’t qualify due to your disability, you’ll have another chance when you turn 65. At that time, you’ll enter your Medigap Open Enrollment Period and Initial Enrollment Period 2, giving you another opportunity to sign up.

How do I Enroll in Medigap Plan G?

Enrolling in Medigap Plan G can feel overwhelming, but we’re here to help. At MAC Insurance, we make the process simple and hassle-free.

Whether you're new to Medicare, turning 65, paying too much for your current plan, or just exploring your options, we can provide Medigap Plan G quotes—without you ever needing to pick up the phone.

Unlike lead generation services, we don’t sell your information. Instead, we connect you directly with one of our experienced Medicare agents who are ready to assist you every step of the way.

Enrolling in Medigap Plan G is simple. Just follow these steps:

1. Check Eligibility – You must have Medicare Part A and Part B to apply.

2. Know Your Enrollment Period – Your best time to enroll is during the 6-month Medigap Open Enrollment Period, which starts when you’re 65 and enrolled in Part B. During this time, you can get any Medigap plan without health questions. If you apply later, you may need to go through medical underwriting.

3. Compare Plans – Look at different insurance companies offering Plan G. Compare prices, coverage, and customer reviews.

4. Contact Insurance Companies – Reach out to providers by phone, online, or through a licensed agent.

5. Complete the Application – Fill out the form with your personal and Medicare details.

6. Submit Required Documents – You may need to provide a copy of your Medicare card or other paperwork.

7. Pay Your Premium – Once approved, pay your first premium to activate coverage.

8. Review Your Policy – Read your policy carefully to understand your benefits and costs.

If you have any further questions about Medigap Plan G or any other topic on this site, feel free to request quotes or more information from us.

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN G

There’s plenty of information online about each plan, but to get an accurate quote, you’ll need the expertise of a licensed Medicare agent. Rather than reaching out to multiple insurance carriers yourself, we can compare premiums from various providers to help you find the best rate.

To generate your quotes, we’ll need to gather some details since your premium is based on factors like your information and health history. However, our services are completely free! If you enroll in a Medigap plan through our agency, you’ll also receive unlimited support—whether you have questions about your plan or need assistance with coverage, we’re always here to help.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Does Plan G cover eye exams?

Plan G doesn’t cover routine eye exams, glasses, or contact lenses. If you have a Medigap plan, you may want to get a separate Dental, Vision, and Hearing (DVH) plan for those benefits.

Does Medigap Plan G cover prescription drugs?

Plan G covers certain medications given during a hospital stay if they're covered by Medicare Part B. For other prescriptions, you'll need a separate Part D drug plan.

Can individuals under 65 enroll in Medigap Plan G?

It depends on the state. Medicare doesn’t require insurance companies to offer Medigap to people under 65, but some states do. In those states, insurers usually offer Plan A, which has the basic benefits. Also, premiums for people under 65 are often higher.

Is Medigap Plan G available with guaranteed issue rights?

You can get Plan G if you're in your open enrollment period or have guaranteed issue rights for certain situations.

How does Medigap Plan G compare to Plan F?

Plan F covers more than Plan G because it includes the Part B deductible. However, it's only available to those who turned 65 before January 1, 2020, and it usually costs more. If you're eligible for both, compare the coverage and premiums to decide which is best for you.

How does Medigap Plan G compare to Plan N?

With Plan N, you’ll pay copays for Medicare Part B and it won’t cover Part B excess charges. Plan G covers both. If you live in a state that bans excess charges, this benefit won’t matter.

Are Medicare Advantage plans better than Medigap Plan G?

There’s no one-size-fits-all answer. It depends on your needs and preferences. If you want more freedom to choose doctors, Plan G is a good choice. If keeping costs low is your priority, a Medicare Advantage plan might be better.

Is Plan G cheaper than Plan F?

Yes, Plan G usually costs less than Plan F. If you're choosing between them, compare the premium difference with the cost of the Part B deductible.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.