Medigap Plan N

Medigap Plan N is a popular choice for those who want lower monthly premiums while still getting good coverage. It’s a good alternative to Plans F and G but requires you to pay the Part B deductible, some copays for doctor and ER visits, and any Part B excess charges.

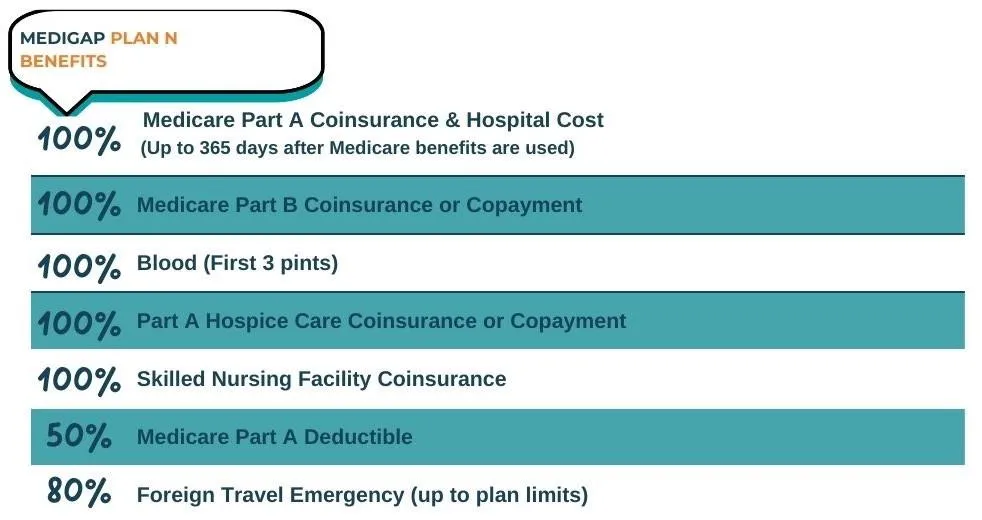

What does Medigap Plan N cover?

Medigap Plan N helps cover costs that Original Medicare doesn’t pay for, offering good value with lower monthly premiums. While it doesn’t cover all out-of-pocket expenses, it does cover:

● Medicare Part A hospital costs for up to 365 extra days

● Part A hospice care coinsurance/copay

● Part A deductible

● Part B coinsurance (except for some copays)

● First three pints of blood

● Skilled nursing facility coinsurance

●80% of foreign travel emergency costs (up to plan limits)

With Plan N, you’ll pay a $20 copay for certain doctor visits, up to a $50 copay for ER visits (waived if admitted), the Part B deductible, and any Part B excess charges unless your state doesn’t allow them, though most doctors accept Medicare assignment, making excess charges rare.

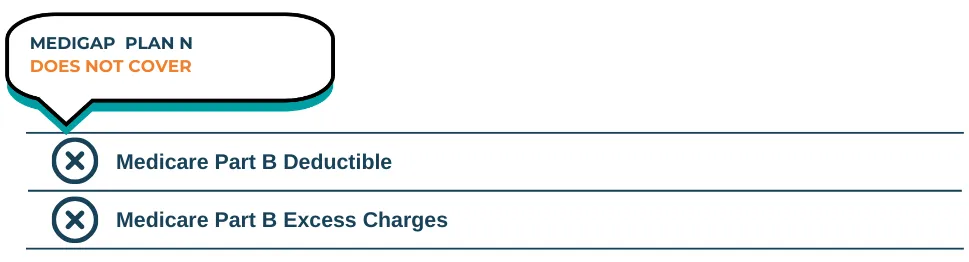

What isn’t covered under Medicare Supplement Plan N?

Medicare Supplement Plan N doesn’t cover the Part B deductible or excess charges. You may also have to pay a $20 copay for doctor visits and a $50 copay for ER visits if you’re not admitted. However, it helps cover many other costs while keeping your monthly premium lower than more comprehensive plans.

Medicare Supplement Plan N eligibility

You can get Medicare Supplement Plan N if you’re enrolled in both Medicare Part A and Part B.

The best time to sign up is during your Medigap open enrollment period, which starts the month you turn 65 and have Medicare Part B. During this time, you’re guaranteed coverage, even with pre-existing conditions, and won’t pay higher premiums because of them.

You can apply for a Medigap plan anytime, but if you do so after open enrollment, you may have to go through medical underwriting. If you need help finding the right plan, a licensed Medicare agent at MAC Insurance can assist you.

Medigap Plan N Copays

For 2025, Medicare Supplement Plan N still offers lower monthly premiums, but you’ll need to pay a $20 copay for doctor visits and a $50 copay for emergency room visits (unless you’re admitted as an inpatient).

Urgent Care visits do not require a copay, making them a cost-effective alternative for minor health issues instead of going to the ER.

These copays do not count toward your Medicare Part B deductible.

Medigap Plan N Rate Increases

Medigap plan costs usually go up each year, but the amount depends on how your insurance company sets prices. In most cases, premiums increase as you get older, and Plan N rates have gone up by an average of 2% to 4% per year over the last five years.

When choosing a Medigap plan, it's important to check how often a company raises its rates. A company might offer a low price at first, but if their rates increase quickly, it could end up costing more over time. Our agents review a company’s rate increase history before making recommendations, and we provide this service at no cost to you.

Comparing Plan N and Plan F

Medigap Plan F provides the most complete coverage, paying 100% of out-of-pocket costs, so members only need to pay their monthly premium. Plan N offers less coverage but comes with lower premiums.

However, not everyone can enroll in Plan F—only those who became eligible for Medicare before January 1, 2020. Plan N remains available to all Medicare beneficiaries in 2025.

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN N

There’s a lot of information available online about each plan, but to get an accurate quote, you’ll need the help of a licensed Medicare agent. Instead of contacting multiple insurance carriers yourself, we can compare premiums from various providers to help you find the best rate.

To provide quotes, we’ll need to gather some details since your premium is based on factors like your information and health history. However, our services are completely free! If you enroll in a Medigap plan through our agency, you’ll also receive unlimited support—whether you have questions about your plan or need assistance with coverage, we’ll be here to help.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

How does Plan N compare to Plan G?

The main difference between Plan N and Plan G is the copays. With Plan N, you’ll pay small copays for doctor visits and emergency room visits, while Plan G does not have these copays. Plan N also doesn’t cover Part B excess charges, but if you live in a state that doesn’t allow them, this won’t affect you. Plan G usually has higher monthly premiums than Plan N.

Which insurance companies provide Plan N?

Because Plan N is a popular choice among Medicare beneficiaries, many large and small insurance companies offer it. However, availability may vary by state.

Does Medicare Supplement Plan N cover the Part B deductible?

No, Plan N does not cover the Part B deductible. Medicare plans that included this coverage were discontinued on January 1, 2020, so anyone who turned 65 after that date is not eligible for them. The only plans that still cover the Part B deductible for those who qualify are Plans C, F, and High Deductible Plan F.

Is a Medicare Advantage plan a better choice than Medigap Plan N?

There isn’t a one-size-fits-all answer—it depends on your needs and preferences. If you want the freedom to choose any doctor who accepts Medicare, Plan N is a better choice. If keeping your monthly costs low is your main priority, a Medicare Advantage plan might be a better option.

Does Medigap Plan N cover physical therapy?

If your doctor says physical therapy is medically necessary, Plan N will cover it.

Does Plan N include dental coverage?

No, Plan N doesn’t cover dental care. If you need dental, vision, or hearing coverage, you may want to enroll in a separate DVH plan.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.