Medigap High Deductible Plan G

This plan offers lower monthly premiums while keeping the flexibility of a Medigap plan. One notable advantage of High Deductible Plan G is that its Premium Increases tend to be more lower.

A key benefit is slower premium increases since it has fewer frequent claims, making it a cost-effective choice for many.

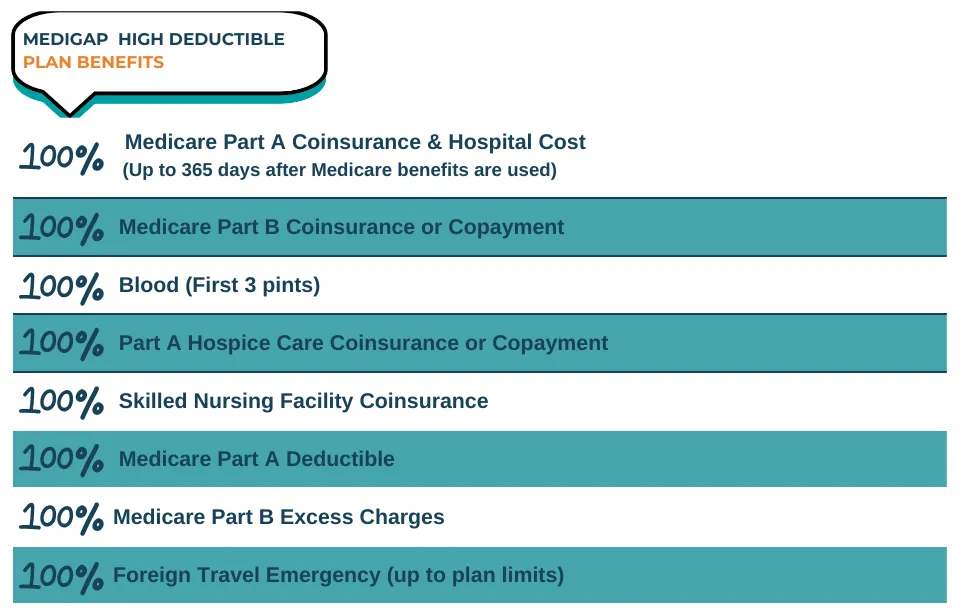

What does Medigap High Deductible Plan G Cover?

This plan offers the same benefits as standard Plan G but with a higher deductible for lower monthly premiums.

Here’s what it covers:

● Hospital Costs (Part A) – Pays for hospital stays beyond 60 days and covers lifetime reserve days.

● Medical Services (Part B) – Covers doctor visits, outpatient care, and excess charges beyond Medicare-approved amounts.

● Blood Coverage – Pays for the first three pints of blood each year.

● Hospice Care – Covers coinsurance and copayments for palliative and respite care.

● Skilled Nursing Care – Pays coinsurance costs after a hospital stay.

● Foreign Travel Emergency – Covers 80% of emergency care outside the U.S. after a $250 deductible (lifetime max: $50,000).

Medigap High Deductible Plan G in 2025

● Deductible: $2,870 in 2025.

● After Deductible: Covers hospital stays, doctor visits, skilled nursing, hospice care, and emergency care abroad.

● Lower Premiums: Monthly costs are lower, but you pay more upfront before coverage starts.

Considering Medigap High Deductible Plan G? MAC Insurance can help you decide if it’s right for you!

How does the deductible work on HD-G?

With High Deductible Plan G (HD-G) in 2025, you must pay $2,870 out of pocket before the plan starts covering costs.

After reaching the deductible, the plan covers most Medicare-approved expenses, including hospital stays, doctor visits, and excess charges.

Because of this higher deductible, the monthly premium is lower than standard Plan G.

If you haven’t seen the Medicare Supplement Comparison Chart yet, take a look by clicking the link here.

Medicare Supplements

How to Compare Rates for

MEDIGAP HIGH DEDUCTIBLE PLAN G

There is a wealth of information about each plan online, but to get an accurate quote, it’s best to work with a licensed Medicare agent. Instead of reaching out to each insurance carrier individually, we can compare premiums from multiple carriers to ensure you find the best rate.

We’ll need to gather some details from you to provide accurate quotes, as your premium depends on your personal information and health history. The best part? Our services are completely free! If you choose to enroll in a Medigap plan through our agency, we offer ongoing support. Whether you have questions about how your plan works or need assistance with your coverage, we’ll be here to help.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Which insurance companies offer High Deductible Plan G?

High Deductible Plan G is a standardized Medicare Supplement plan, meaning its benefits are consistent across all insurance companies. However, premiums can vary depending on the insurer and your location. It's important to compare rates from different carriers to find the best option for your needs.

How does High Deductible Plan G compare to standard Plan G?

The only difference is the deductible. The high deductible plan has a larger upfront cost but lower monthly premiums.

Is High Deductible Plan G a good choice?

The main downside of this plan is the high deductible, so it’s not the best fit for everyone. However, if you want lower monthly premiums without losing coverage, it can be a good choice.

It’s popular with people used to high-deductible employer plans. If you have savings to cover the deductible, this plan could work well for you.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.