Medigap Plan L

Medigap Plan L still helps cover costs that Original Medicare doesn’t pay, like coinsurance, deductibles, and copays. The annual out-of-pocket limit has increased to $3,610.

Plan L has lower premiums but requires some cost-sharing. Once you reach the out-of-pocket limit, it covers 100% of Medicare-approved costs for the rest of the year.

It’s available in all states, and you can see any doctor or hospital that accepts Medicare without referrals. To enroll, you must have Original Medicare (Parts A and B).

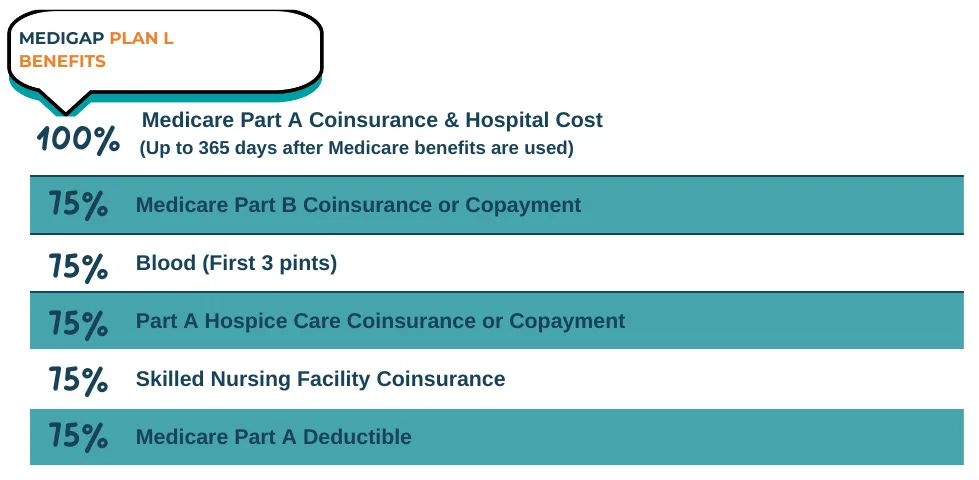

What does Medigap Plan L cover?

Medigap Plan L helps cover some Medicare costs with a lower monthly premium due to cost-sharing. In 2025, it covers 75% of:

● Medicare Part B coinsurance/copay

● Part A hospice care coinsurance/copay

● Medicare Part A deductible

● First three pints of blood

● Skilled nursing facility care coinsurance

It fully covers Medicare Part A coinsurance and hospital costs for up to a year after Medicare benefits run out.

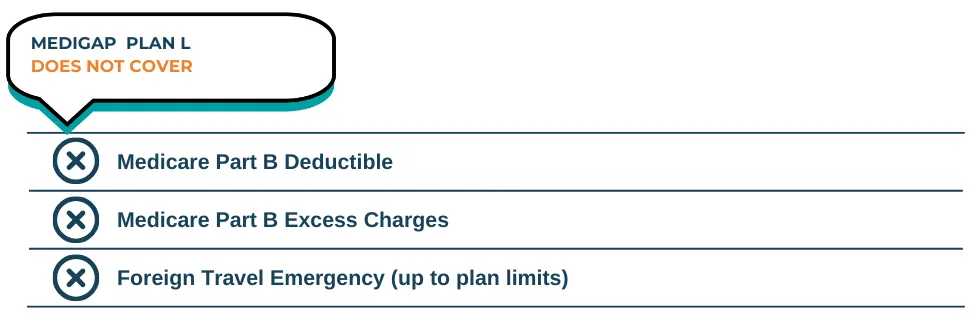

Plan L does not cover the Part B deductible or excess charges, but these are rare and restricted in some states. Due to cost-sharing, it typically has lower premiums than more comprehensive plans like Plan F.

Medicare Supplement Plan L out-of-pocket costs

With Plan L, you will be responsible for certain out-of-pocket costs related to Medicare, including:

● Medicare Part B deductible

● Medicare Part B excess charges

● Foreign travel emergency

You’ll pay 25% of certain Medicare costs, including coinsurance, copays, skilled nursing care, Part A’s deductible, and the first three pints of blood.

Because you share these costs, your monthly premiums will be lower.

Medigap Plan L Premiums

In 2025, Medigap Plan B premiums typically range from $110 to $210 per month. These premiums vary based on factors like your state of residence, the insurance provider, age, gender, and tobacco use. Generally, states with higher living costs may have higher premiums.

Medigap Plan L out-of-pocket maximum cap protection

Plan K is one of two Medigap plans with a maximum out-of-pocket (MOOP) limit. In 2025, this limit is $3,900 and may increase each year. Once you reach this amount, Plan K covers 100% of your Medicare costs for the rest of the year.

If you want lower premiums while still getting help with Medicare expenses, a licensed Medicare agent at MAC Insurance can assist you.

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN L

There is a lot of information about each plan online, but to get an accurate quote, you’ll need to enlist the help of a licensed Medicare agent. Instead of calling each insurance carrier to get a quote, we can compare premiums across many different carriers, ensuring that you enroll with one that gives you the best rate.

We’ll need to collect some information from you in order to provide quotes since your premium is based on your information and health history, but our services come at no additional cost to you! If you choose to enroll in a Medigap plan through our agency, we also offer unlimited support. If you have problems with your coverage or have questions about how your plan works, we will be here to help.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

When can I enroll in Medigap Plan L?

You can enroll in Plan L once you're enrolled in Original Medicare (Parts A and B). The best time to sign up is during your six-month Medigap open enrollment period, which starts when your Part B coverage begins. During this time, you have guaranteed issue rights, meaning you can get coverage without health restrictions. After this period, you may be denied coverage based on your health history.

Is Medigap Plan L a good choice for Medicare beneficiaries?

Any extra coverage beyond Original Medicare is beneficial. Plan L has lower premiums than some other Medigap plans, making it a good choice for those who don’t mind some cost-sharing. It also has an annual out-of-pocket limit, which can help manage high medical costs.

Does Medigap Plan L cover prescription drugs?

Medigap Plan L, like all Medigap plans, does not cover prescription drugs, except for some given during a hospital stay. If you need drug coverage, you should enroll in a separate Medicare Part D plan.

Does Medigap Plan L cover psychiatrist visits?

Medigap plans only cover services that Original Medicare (Parts A and B) covers. Since Part B includes mental health benefits, including psychiatrist visits, Plan L helps cover those costs.

Should I choose Plan F or Plan L?

First, check if you're eligible for both plans. If you turned 65 after January 1, 2020, you can't enroll in Plan F. Plan L is a good alternative with lower premiums, but you'll share some costs.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.