Medigap Plan K

Medigap Plan K is a cost-sharing plan with a lower monthly premium. It covers 50% of your coinsurance, copays, and the hospital deductible under Original Medicare. You'll pay more out-of-pocket than with other Medigap plans, but there's a yearly limit on how much you have to spend.

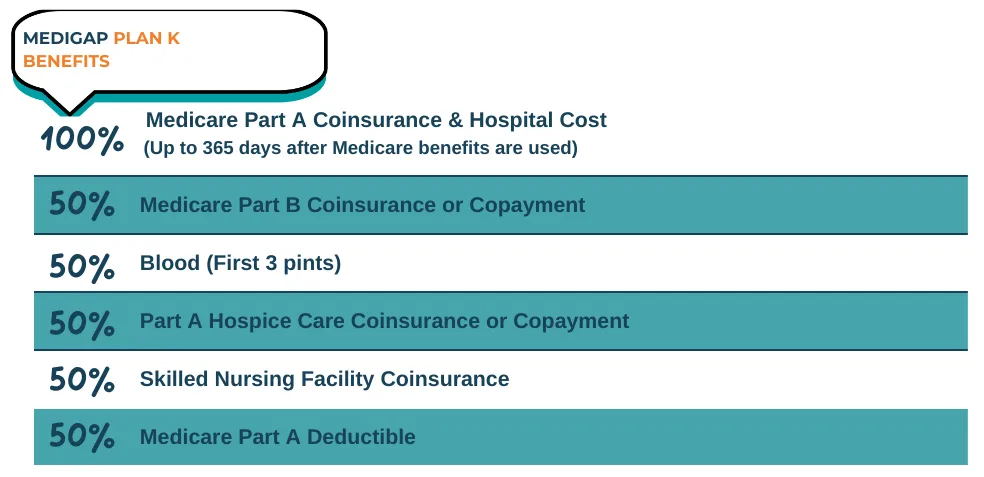

What does Medicare Supplement Plan K cover?

In 2025, Medicare introduced significant changes affecting coverage and costs:

Medigap Plan K Updates:

Out-of-Pocket Limit Increase: The annual out-of-pocket maximum for Medigap Plan K has risen to $7,220 in 2025, up from $6,940 in previous years. Once you reach this limit, Plan K covers 100% of your Medicare-approved costs for the rest of the year.

Coverage Details: Plan K continues to cover 50% of certain costs not fully paid by Original Medicare, including:

● Medicare Part A deductible

● Hospice care coinsurance or copayments

● Skilled nursing facility care coinsurance

● Medicare Part B copayment or coinsurance

● First three pints of blood for a covered medical procedure

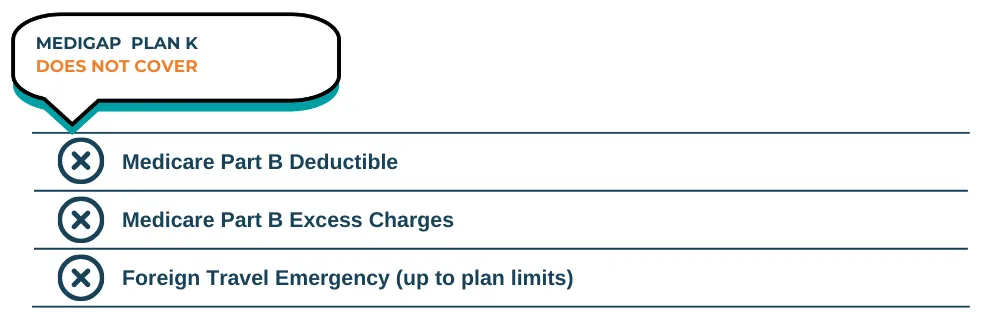

It does not cover the Part B deductible, excess charges, or foreign travel emergencies.

Medicare Part D Prescription Drug Changes:

● Out-of-Pocket Cap: Starting in 2025, there is a $2,000 annual cap on out-of-pocket prescription drug costs under Medicare Part D. This change aims to reduce the financial burden on beneficiaries requiring medications.

● Payment Flexibility: Beneficiaries now have the option to spread out their prescription drug costs over 12 months, providing more manageable payment plans.

Medicare Advantage (MA) Plan Enhancements:

● Midyear Benefit Statements: Medicare Advantage plans are now required to provide midyear statements detailing any unused benefits. This transparency helps beneficiaries better understand and utilize their coverage.

● Support for Caregivers: A new program, the GUIDE (Giving U.S. Infrastructure Development for Eldercare) model, offers resources and up to $2,500 annually for respite care to support caregivers of individuals with dementia.

Recommendations:

Given these updates, it's crucial to:

● Review Your Coverage Annually: During the enrollment period from October 15 to December 7, assess your Medicare Advantage or Prescription Drug plans to ensure they meet your current healthcare needs and take advantage of new benefits.

● Consult a Licensed Medicare Agent: Professionals, such as those at MAC Insurance, can provide personalized advice to help you navigate these changes and select the best plan for your situation.

Staying informed about these changes ensures you maximize your Medicare benefits and make cost-effective healthcare decisions.

Alternatives to Plan K

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN K

There’s a wealth of information online about each plan, but to get an accurate quote, you’ll need the guidance of a licensed Medicare agent. Instead of contacting multiple insurance carriers individually, we can compare premiums from various providers to help

you secure the best rate.

To provide quotes, we’ll need to gather some details, as your premium is based on factors like your information and health history. However, our services are completely free! If you enroll in a Medigap plan through our agency, you’ll also receive unlimited support—whether you have questions about your plan or need help with coverage, we’re always here for you.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Who can enroll in Medigap Plan K?

Anyone with Original Medicare (Parts A and B) can enroll in Medigap Plan K.

Which insurance companies provide Medigap Plan K?

Many insurance companies offer High Deductible Plan G, but availability varies by state. No matter which company you choose, the benefits are the same—the only difference is the price.

Does Plan K include benefits for eye exams?

Plan K doesn’t cover routine eye exams, glasses, or contact lenses. If you have a Medigap plan, you may want to get a separate Dental, Vision, and Hearing (DVH) plan.

What factors should I consider when deciding between Medigap Plan F and Plan K?

Plan F covers more but has higher premiums than Plan K. Also, it's only available to people who turned 65 before January 1, 2020. If you're eligible for both, compare the costs and coverage to see which works best for you.

What is the deductible for Medigap Plan K?

Plan K doesn’t have its own deductible, but you’ll need to pay 50% of the Part A deductible and 100% of the Part B deductible. These amounts can change each year.

Is Medigap Plan K a good plan?

Plan K is a good option if you want a lower monthly premium. You'll share some costs, but it also covers certain benefits for travel outside the U.S. While it’s not the most comprehensive plan, it offers good value for the price.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.