Medigap Plan M

Plan M is a good option for those who want a lower monthly premium and are comfortable paying some out-of-pocket costs. It helps cover expenses that Original Medicare doesn’t fully pay for, but you’ll be responsible for part of your Medicare deductibles.

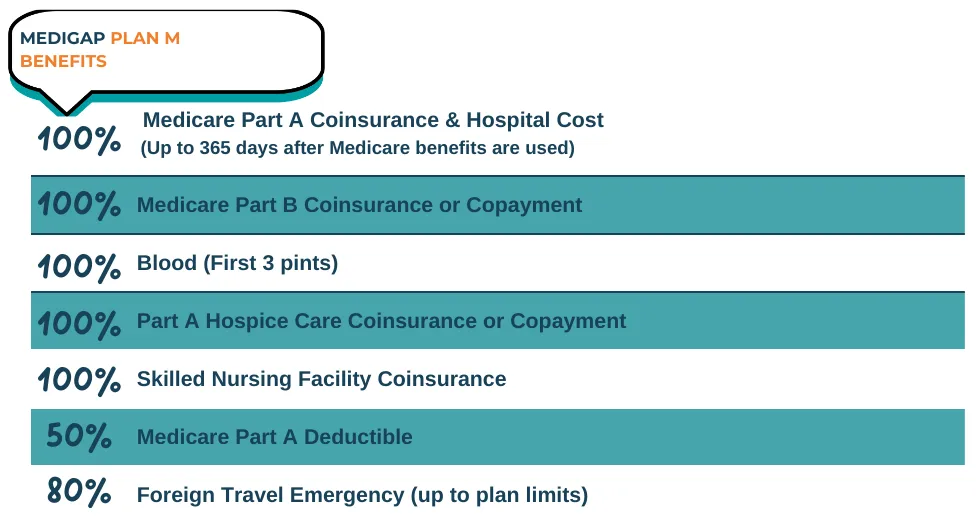

What does Medigap Plan M cover?

Medicare Supplement Plan M covers:

● Medicare Part A hospital and coinsurance costs for up to a year after Original Medicare benefits are used up

● Part A hospice care coinsurance and copayments

● Medicare Part B coinsurance and copayments

● First three pints of blood for a medical procedure

● Skilled nursing facility care coinsurance

● 50% of Medicare Part A’s deductible

● 80% of approved costs for foreign travel emergency (up to plan limits)

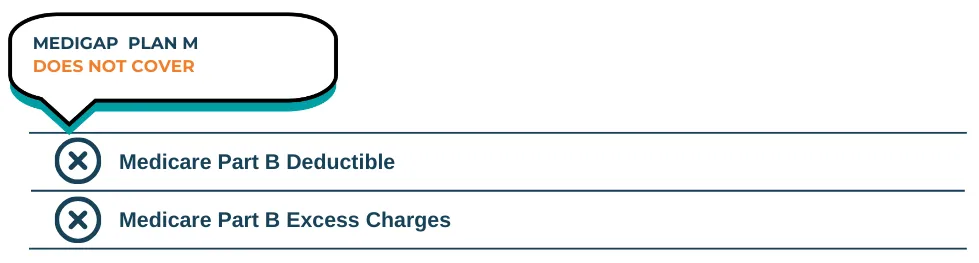

Plan M does not cover the Part B deductible or excess charges, but excess charges are rare and even banned in some states. It fully covers all Medicare Part B coinsurance and copays, plus an extra 365 days of hospital coverage after Medicare benefits are used up.

Medicare Supplement Plan M Cost-Sharing

By covering 50% of the Medicare Part A deductible and requiring you to pay the Part B deductible ($240 in 2025), Medigap Plan M offers a lower premium compared to more comprehensive supplement plans.

Plan M and Prescription Drug Coverage

Medigap Plan M covers prescription drugs given during inpatient care but does not cover medications you take at home. To get coverage for prescriptions, you’ll need to enroll in a separate Part D plan.

Guaranteed issue Medicare Supplement insurance

What is Guaranteed Issue?

Guaranteed issue rights let you enroll in a Medigap plan without health questions or higher premiums due to pre-existing conditions.

When Do Guaranteed Issue Rights Apply?

● When You First Enroll in Medicare – You have a 6-month open enrollment period after signing up for Medicare Part B to choose any Medigap plan with no medical underwriting.

● Losing Other Health Coverage – If you lose employer or other health insurance, you may qualify to enroll in a Medigap plan without health questions.

● Trial Rights – If you try a Medicare Advantage plan and switch back to Original Medicare within a year, you can get a Medigap plan without underwriting.

● Plan Changes or Moving – If your Medicare Advantage plan changes significantly or you move out of its service area, you may also have guaranteed issue rights.

These protections ensure you can get Medigap coverage when certain life changes happen.

The Best Alternative to Plan M

The best alternative to Plan M depends on your budget and coverage needs, with Plans F and G offering more coverage at higher premiums, while Plans K and L have lower premiums but less coverage.

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN M

There’s plenty of information online about each plan, but to get an accurate quote, you’ll need the assistance of a licensed Medicare agent. Instead of reaching out to multiple insurance carriers for quotes, we can compare premiums from various providers to help you find the most competitive rate.

To generate your quotes, we’ll need to gather some details, as your premium is based on factors like your information and health history. However, our services are completely free! If you enroll in a Medigap plan through our agency, you’ll also receive unlimited support—whether you have questions about your plan or need help with coverage, we’re always here for you.

ADDITIONAL QUESTIONS TO BE ADVISED ON:

Is Plan M still available?

Yes, Plan M is available for all Medicare beneficiaries to enroll in.

How does Plan M compare to Plan N?

The best plan depends on your healthcare needs and budget. Plan M requires you to pay 50% of the Part A deductible, while Plan N has copays for Part B services.

Can I switch from Plan M to Plan F?

If you turned 65 prior to January 1, 2020, you may be able to move to Plan F. However, if you do not have guaranteed issue rights, you will have to first pass medical underwriting.

When am I eligible to enroll in Plan M?

You can enroll in Plan M if you have Original Medicare (Parts A and B). The best time to sign up is during your six-month open enrollment period, which starts when your Part B coverage begins. During this time, you can get Plan M without worrying about health checks. After this period, your application could be denied based on your health history.

Does Medigap Plan M cover vision care?

Medigap Plan M, like other Medicare supplement plans, does not cover routine eye exams, glasses, or contacts. If you need vision coverage, consider getting a separate Dental, Vision, and Hearing (DVH) plan.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.