Medigap Plan C

Medigap Plan C is a popular Medicare supplement because it helps cover most costs that Original Medicare (Parts A and B) doesn’t, except for Part B excess charges. It reduces out-of-pocket expenses and offers broad coverage compared to other Medigap plans.

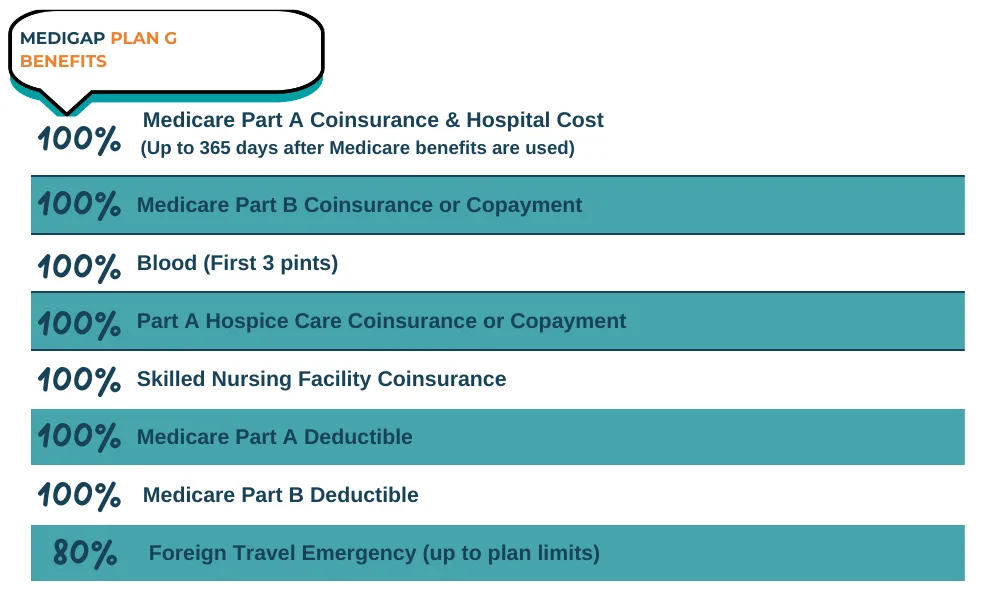

What does Medicare Supplement Plan C cover?

Medigap Plan C covers almost all costs except Part B excess charges. If you live in a state that bans these charges, this won’t matter. It also provides first-dollar coverage, meaning no deductible is needed.

● Medicare Part A coinsurance for inpatient hospital care, extending up to 365 additional days after

● Medicare benefits are exhausted

● Medicare Part B copayments or coinsurance costs

● The cost of the first three pints of blood for medical procedures

● Coinsurance or copayment for Part A hospice care

● Medicare Part A deductible

● Medicare Part B deductible

● Coinsurance for skilled nursing facility care

● Emergency medical coverage during foreign travel

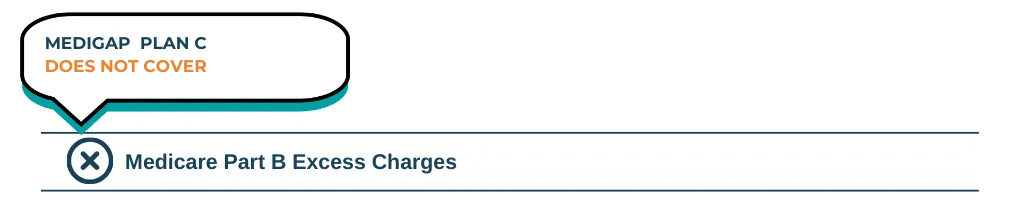

What are Medicare excess charges?

Excess charges are extra fees some doctors can charge, up to 15% more than what Medicare covers. Most doctors don’t charge them, but if you want coverage for this, other Medigap plans include it. A MAC Insurance agent can help you find the right plan.

Medicare Supplement Plan C Eligibility

Getting a Medicare Supplement plan is easy. Once your Medicare Part B is active, you have six months to enroll without higher premiums due to health conditions. We recommend signing up as soon as you're eligible. However, you can enroll anytime. If you have questions, our licensed Medicare agents are ready to help!

Individuals Who Benefit from Plan C

Plan C is a good choice for those who visit the doctor or hospital often, travel outside the U.S., and can afford a higher monthly premium.

Medigap Plan C Premiums

In 2025, Medigap Plan B premiums typically range from $110 to $210 per month. These premiums vary based on factors like your state of residence, the insurance provider, age, gender, and tobacco use. Generally, states with higher living costs may have higher premiums.

Comparing Plan C and Plan G

The main difference is that Plan C covers the Part B deductible, while Plan G does not. Plan C is only available to those who became eligible for Medicare before January 1, 2020, and in 2025, it still typically has higher premiums than Plan G.

Medigap Plan C versus Medicare Part C

Medicare "parts" refer to Original Medicare benefits, while "plans" are Medicare supplements.

Medicare Part C is a Medicare Advantage plan that replaces Original Medicare and may offer extra benefits. Medigap Plan C, on the other hand, is a supplement that helps cover costs not paid by Medicare Parts A and B.

Medicare Supplements

How to Compare Rates for

MEDIGAP PLAN C

There’s plenty of information about each plan online, but to get an accurate quote, you’ll need assistance from a licensed Medicare agent. Instead of reaching out to multiple insurance carriers individually, we can compare premiums from various providers to help you find the best rate.

To provide you with quotes, we’ll need to gather some details since your premium is based on factors like your information and health history. However, our services come at no extra cost to you! If you enroll in a Medigap plan through our agency, you’ll also receive unlimited support—whether you have questions about your plan or need help with coverage issues, we’re here for you.

📩 Contact us today and let us represent you for FREE!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Copyright © 2026 MAC Insurance. All rights reserved.